Corporate social responsibility has become increasingly popular in recent years. A 2018 study found that 78% of Americans expect companies to go beyond making profits and that they must also make a positive impact on society. As consumers become more socially conscious, corporations have had to embrace social impact as a value.

This is part of the allure of the online private markets. Retail investors can invest in any company that aligns with their values, support underrepresented founders, and more.

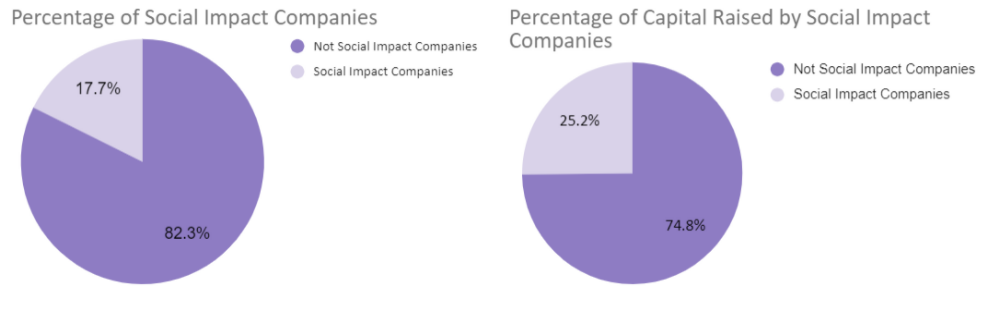

This week we broke down both the percentage of social impact companies that raise via equity crowdfunding as well as the percentage of total capital raised that went to companies with a social impact mission. The data was pulled from Regulation Crowdfunding equity deals that closed between January 1 and May 31, 2021.

Overall, social impact companies made up about 17.7% of total equity deals that closed in the first five months of 2021. Surprisingly, the percentage of overall funding that went to social impact companies was higher at 25.2%. This suggests that individual startup investors care deeply about supporting companies that have a social impact, to the point where they may actually be putting too much weight on social impact as a criteria for investment.

There are several social impact ventures like Airthium and InnaMed and new-age investing models democratizing access to capital like Backstage Capital, Wefunder, and Republic. These are just a few examples of how online private markets offer individuals an opportunity to actively and intentionally invest in the values they believe in.

Note: all data used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.