Deal To Watch: Reinventing the Combustion Engine

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

LiquidPiston has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

In a world that is moving ever more rapidly toward electric engines, the appeal of internal combustion engines (ICEs) may seem dull. Though it is true that the age of the ICE is slowly drawing to an end, continued innovations in the space are making them smaller. They are also making them lighter, and more efficient than ever before. This will not save the industry, but it will slow down the transition to alternatives. In the process, countless billions of dollars stand to be generated. Along the way, one company that sees itself as a prime contender moving forward is LiquidPiston.

Problem

ICEs are large, heavy, and inefficient. As the world becomes more environmentally-conscious, the shift away from them and toward electric alternatives makes plenty of sense. That said, it doesn’t mean that companies can or should stop innovating. At some point in the future ICEs will no longer exist. Having said that, capitalizing on valuable innovations in the meantime is logical and could be valuable.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Solution

The key to innovating in the ICE space is to find technological solutions to the problems facing the devices. Examples of this could include addressing their size, efficiency, and environmental friendliness. One company determined to do just that is LiquidPiston. Building off of 15 years of research and development, the team behind the company has created the X-Engine, or X-Mini as they also call it.

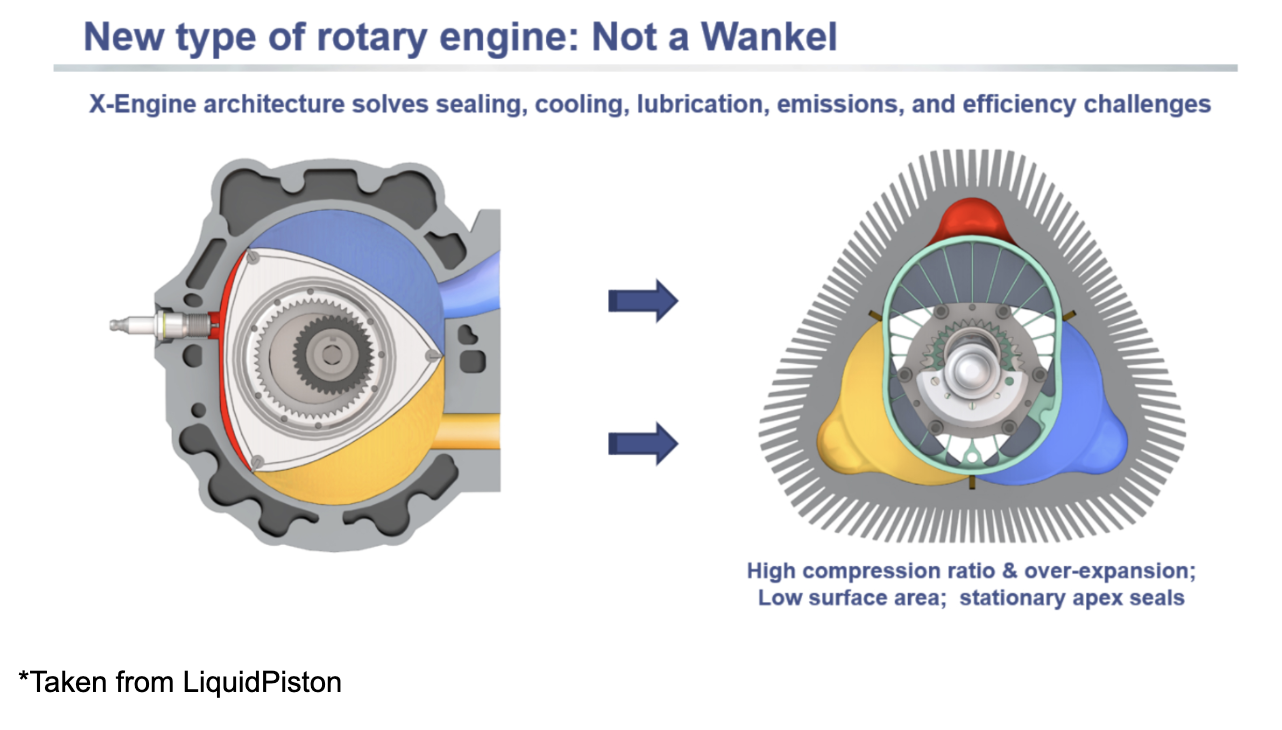

The company’s engine is described as an advanced rotary ICE that’s based on the firm’s patented thermodynamic cycle. The company also stresses the importance of its ‘novel’ rotary engine architecture. As of this writing, LiquidPiston has 35 patents on its technology, on top of 16 patents pending. As the image below illustrates, their take on the ICE is substantially smaller than a typical ICE. In all, it’s up to 10 times smaller and lighter than the competition. LiquidPiston claims that its ICE is also 30% more efficient than comparable diesel engines. They accomplished this by eliminating non-essential movements and by utilizing other recent advancements.

Some individuals familiar with the ICE space may liken LiquidPiston’s innovation to a Wankel engine. But that would be a mistake according to management. As the image below illustrates, there are key differences between how the two types of engine move. Wankel engines are generally considered weaker and less fuel-efficient than most modern-day ICEs. By comparison, the architecture and processes surrounding LiquidPiston’s “High-Efficiency Hybrid Cycle” X-Engine make it comparable to today’s top ICEs. In fact, according to management, the X-Engine’s design could make it scalable to the point of delivering 500+ hp in due time.

Looking at the financial side of things, a red flag appears. With a startup, especially a high-priced one like LiquidPiston, you would ideally want to see rapid sales growth. Another thing you would probably want to see at this point would be an improving bottom line. Neither was the case for LiquidPiston between its 2017 and 2018 fiscal years. In 2017, sales came in at $3.28 million. Revenue declined to $2.84 million a year later. The firm’s net profit of $137,474 in 2017 and operating cash flow of $231,259 that same year turned into a loss of $949,708 and a net cash outflow of $783,723 in 2018.

Though these changes from year-to-year would look concerning for most any startup, context is important. Unlike most firms in this stage of life, LiquidPiston is actually not generating revenue from traditional clients. It is, instead, relying on private and government contracts. Using these proceeds, the company continues to innovate and then tests their innovations. This is different from traditional selling to clients because the contracts may pay out upon certain milestones. The timing of payouts could also materially affect sales in any given year. In its life so far, the company has landed $9 million worth of contracts for the Department of Defense, including with DARPA and the US Army. For DARPA specifically, it has already seen more than $6 million come its way, with the company’s primary focus there being its newer X-4 Engine. The company also landed, in 2019, four different partner pilot studies worth a collective $1.1 million. Three of these feasibility studies have been with industrial firms.

In its activities with the Department of Defense, the company has been rather active. With DARPA, it has been working on the development of a 30kW compression ignition engine. It can be used for UAVs, generators, and other applications. One of the company’s prototypes for the US Army is 30% the weight of the generators currently deployed for the organization’s M777 Howitzer. It is in initial field testing as of LiquidPiston’s latest update. The company is also a finalist in the US Army xTechSearch 3.0 Competition.

One very important thing to note about LiquidPiston is that its goal is not to manufacture and sell engines. Its aim, instead, is to create new and innovative technologies in this space. From there, it intends to then license those technologies out to firms that are interested in manufacturing and selling them. Initially, management intends to emphasize two areas to partner up with companies: aerospace and defense. As the image below illustrates, once the company creates a meaningful presence for itself in one niche, it wants to expand out. This is logical because it allows market capture that, in turn, can fuel growth to new markets.

An Interesting Market

The market LiquidPiston operates in can best be described in one word: interesting. Some investors may see the ICE space as a stable, slowly-growing industry, but the fact of the matter is that this is only temporary. Indeed, over the next few years, the space should grow considerably. Back in 2017, 157.11 million ICE units were sold globally. This figure is expected to grow at a rate of 4.9% per annum through 2025. In that year, 230.35 million units are expected to sell on the market. Surprisingly, no reliable public information exists covering the entire range of value in the space. But some data for commercial ICEs suggest that the market in 2016 totalled $166.9 billion. That same source projected that by this year the industry would grow to $208.3 billion. Add in the industrial side to the ICE industry, and it’s likely the industry is materially larger than this.

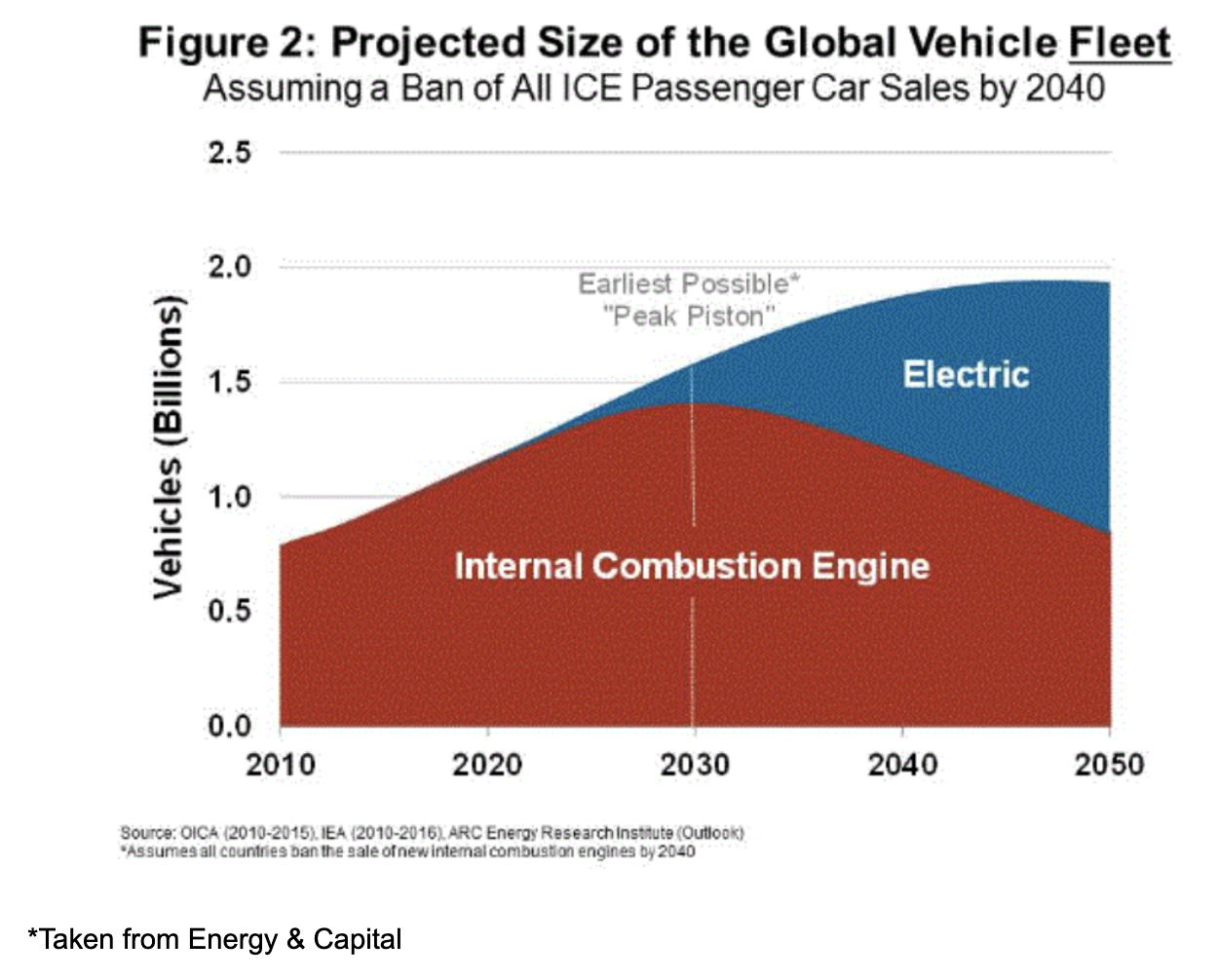

Moving forward, what opportunity does exist in this space will peak and then eventually shrink. As the images above and below illustrate, current forecasts imply that the peak year for ICEs will be somewhere around 2030. In the years that follow, the number of units on the market will gradually fall. Part of this paradigm shift can be chalked up to improving technology. Several years ago, the thought that a BEV engine could compete with a traditional ICE on price would have been incomprehensible. But in a recent report by Deloitte, the consulting firm claimed that the cost of a BEV will approximately equal the cost of an ICE by 2022. Another piece of the pie, though, is entirely political in nature.

Through today, several countries have already announced proposed bans on ICEs. These include the UK, France, Norway, India, and the Netherlands. Some of these are planned to begin by 2025. However, widespread banning will likely not occur for some time. Denmark, for instance, has pushed for a ban on the sale of new gasoline and diesel cars by 2040 across the EU. Several other nations have followed suit on this call. Individual companies are also responding to this expected transition. Volkswagen Group, for instance, has said that the development of its final generation of all-new ICEs will occur sometime in the mid-2020s. Germany company Continental AG has decided to spin off its powertrain systems group, and other companies are following suit as well.

Should outright bans come to pass, this could take a toll on LiquidPiston and its shareholders. On the other hand, though, anything shy of a comprehensive ban could also be an opportunity for them to benefit. Their small, more cost-efficient, and more environmentally-friendly engine could be seen as a bridge separating the ICE industry and the EV space. This could give the company an opportunity to capitalize on this space, while other players starve. The boon this provides could serve to push sales of LiquidPiston higher. This could occur even as more traditional players might suffer declining sales. So, in effect, this industry change could help create value for the firm over the next several years.

Terms of the Deal

LiquidPiston’s current capital raise is oversubscribed at about $1.07 million. This is despite the fact that management is asking investors to accept a pre-money valuation of $51.63 million. This figure is astronomical for the amount of revenue and net income/loss the company has generated. At the same time, though, the company has needed significant capital over time to grow. Since inception, $32 million has been invested in the firm. This is split between investor capital and contracts awarded to the business by third parties. Management is conducting this raise with common shares priced at $36.50 apiece, subject to a minimum per participant of $255.50.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

An Eye on Management

With the possible exception of its patents and government contracts, the strongest thing supporting the value of LiquidPiston is the experience of its management team. First, we have Alexander Shkolnik, the company’s Co-Founder and CEO. He has a PhD in Computer Science / Artificial Intelligence from MIT. His technical focus is on leading teams in modelling dynamic systems, optimization and controls. He holds more than 50 patents to his name and 30 conference/journal papers and he was the PI on $9 million worth of government R&D programs.

Though impressive, the company’s other Co-Founder, who also serves as its CTO, is equally impressive. That is Nikolay Shkolnik. He earned his PhD in Physics from UConn. He also served as a former Clean Energy Program Director at GEN3. Before that, he won the Motorola award for Creativity. He holds more than 60 patents spread across the engine, fuel cells, supercapacitor, and other spaces. Though not a Co-Founder, another high-profile member of the group is Per Suneby. He serves as the company’s VP of Corporate Development. He also currently serves as a Managing Director at Sternhill Associates. He is a seasoned cleantech startup executive, and a New England Clean Energy Fellow. His educational background includes his MBA from Harvard and a BASc in Electrical Engineering from the University of British Columbia.

The Rating: Deal To Watch

After careful consideration and in-depth research, LiquidPiston has been rated a “Deal To Watch”. The company’s technological position is incredibly impressive. The same can be said of its government contracts. Another really impressive thing is the fact that the business has multiple engines that it can actually demonstrate. Add to this the large industry the firm operates in, the top-notch company team, and focused strategy, and this deal is very close to being a “Top Deal”. There are, however, a few issues that prevent it from receiving that high status.

For starters, you have the industry trend moving forward. We believe that LiquidPiston is in a better position during this stage in the life of ICEs than most other firms. It will be able to grab market share while others are struggling not to lose it. Even so, the trend the market will take in years to come is discouraging. This is especially true when you consider the myriad of countries pushing for outright bans to ICEs. Another issue is that the valuation of the business appears high. Financials worsened in 2018 compared to 2017. This is due to the contract nature of the firm so it should be understandable. Even so, understandable is far different than attractive. These concerns should not be overlooked. This is because, when taken together, they are important for management to address. After all, they have the potential to materially impact the value of the enterprise. With these worries thrown into the mix, it becomes just too hard to settle on a Top Deal designation. The alternative, a Deal To Watch, is the next step down, and with the firm’s strong traction as robust as it is, it is with high conviction that we settle on it.

About: Daniel Jones

Daniel Jones is a graduate of Case Western University with a degree in Economics. He has spent several years as an equity analyst writer for The Motley Fool where he focuses primarily on the Consumer Goods sector but also likes to dive in on interesting topics involving energy, industrials, and macroeconomics, in addition to contributing equity research to publications such as Seeking Alpha.