Derby Games

Putting the fun and games back into gambling

Overview

Raised: $0

Rolling Commitments ($USD)

11/23/2019

$0

2011

Media, Entertainment & Publishing

New York, New York

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

The Derby Games team has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

The US gambling industry is large, especially when you add in illegal sports gambling conducted every year. State legislators are coming to realize that the space isn’t going anywhere. Keeping it illegal only relegates its activities to the black market. By legalizing it, the industry becomes a visible part of the economy. There’s also the added benefit of it contributing to state and federal tax revenues. Leading the way is the legalization of horse racing which, online, is permitted in 41 US states. Derby Games, a startup based in New York City, has decided to capitalize on this through their iOS app and website properties.

Problem

Gambling has significant appeal. But due to geographical and legal limitations, it has evolved into a highly-fragmented industry. The end result is an industry with tens of billions of dollars worth of annualized revenue that’s split between countless small firms. Perhaps an even larger issue than this, though, is just how much gambling is done through the black market. The accuracy of this data is debatable, but sources indicate that between $67 billion and $380 billion is wagered illegally in the US every year. This compares to the $40.3 billion in total commercial casino revenue seen in the US in 2017.

Solution

Americans have a clear desire to gamble. That much is indisputable. With online horse racing gambling legal in the vast majority of the US, Derby Games has taken it upon itself to satisfy this thirst. Through their app, they allow users to place wagers for events at more than 100 locations nationwide. Since its inception, the firm has launched four major offerings. The first of these is Derby Jackpot. This service acts as a social game for betting on online horse races that also offers other features like slot machines and playing cards. The company’s Derby Lotto allows players to bet huge racing jackpots in a manner that’s similar to playing the lottery. Derby Elite provides its users something more in line with a classic wagering experience. Derby Practice, meanwhile, gives users the ability to buy digital currency to practice making bets before doing the real thing. Through its platform, the company allows and encourages users to communicate with one another as well. This effectively turns the experience into a gambling/social network hybrid.

So far, the results of the company’s operations have been impressive. The average handle/player is about $2,200, and the company has received over 600,000 sign-ups across the US. 200,000 of these are verified accounts and 35,000 are currently funded. In all, more than $75 million in bets have been placed on the platform since it was founded in 2011.

Derby Games’ revenue strategy is straightforward and simple. Management eschews the traditional method of serving as ‘the house’ that gamblers bet against. Instead, the company takes a commission of around 20% from every bet placed. In addition to this, the firm generates revenue from the sale of its digital currency on its Derby Practice platform. Due to these two revenue sources, the company saw sales in 2018 of $2.49 million. This was down 3.9% from the $2.59 million in sales seen one year earlier. Management stated that their aim during this timeframe was not necessarily to grow sales but, rather, to focus on cutting costs. Due to this emphasis, the firm’s net loss of $303,838 in 2017 turned to a net profit of $213,979 last year. Over the same timeframe, its operating cash outflows of $135,879 turned into a net cash inflow of $116,646.

Already, the company is operating in all but 11 states nationwide. This gives them a reach roughly 180 million American adults. Of the states they do not currently have a presence in, they have identified 4 as being potential areas of expansion. Though not stated by management outright, the firm’s expansion into other areas of the gambling space seems logical. If nothing else, it would open additional revenue channels for the business.

A Mixed Market

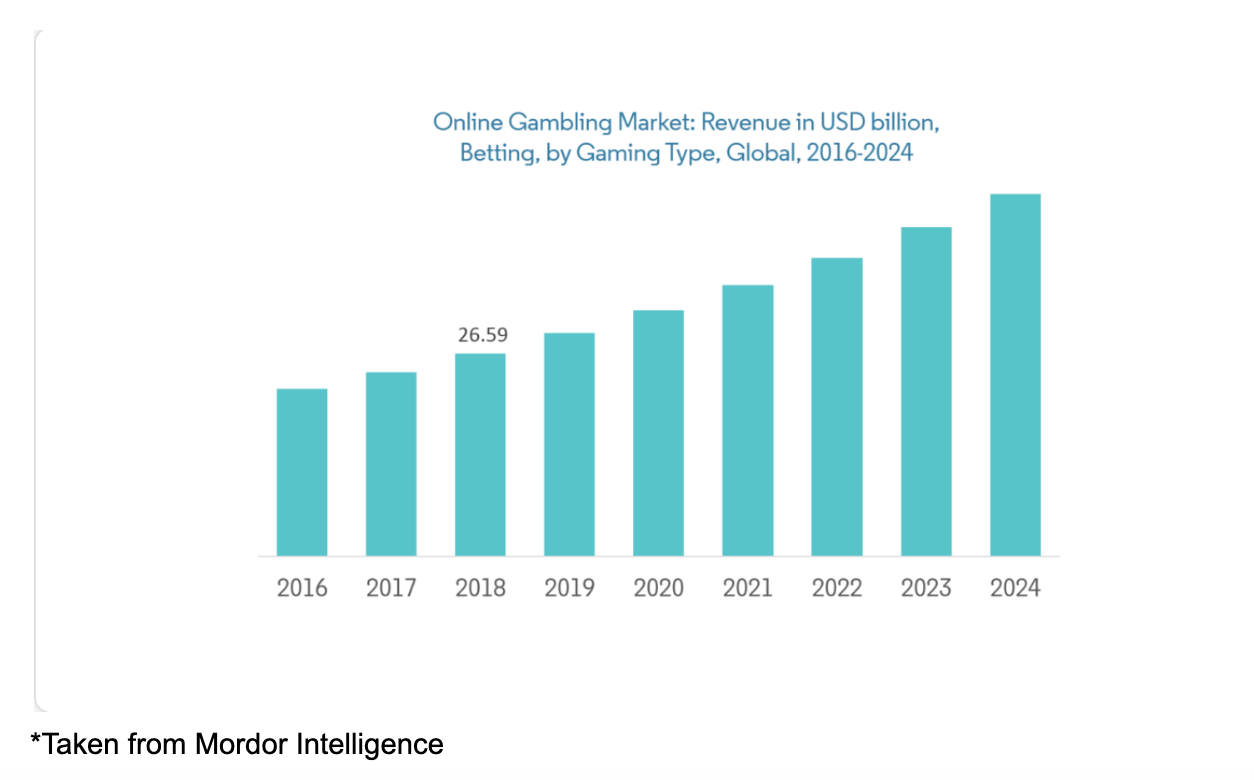

The market for gambling is difficult to understand. The reasons here are twofold. For starters, it’s hard to measure an industry that’s still mostly dominated by the black market. This is made all the more challenging by how fragmented this space is. In aggregate, and as shown in the image above, the total market for online gambling in the US was about $26.6 billion in size back in 2018. Assuming current growth rates continue, the space should rise to around $44 billion in size by 2024, boasting a CAGR of 8.77%. This far outpaces the 3.4% growth rate seen by the commercial casino industry. Between 2016 and 2017 alone, revenue in this market expanded from nearly $39 billion to $40.3 billion.

Perhaps the best data for Derby Games’ niche, however, comes from one of the company’s largest competitors: Churchill Downs. Through its ownership in TwinSpires, the company allows race track betting from 350 race tracks across 14 countries. Betting is available 365 days per year, 24 hours per day. TwinSpires handles an estimated 203,000 races every year and has grown rapidly over time. In 2008 (its first full year operating), the service handled $234 million in bets. By 2018, this had grown to $1.39 billion. In the image below, you can see that the horse racing industry itself is about $11.3 billion in size. This is up from a multi-year low of $10.6 billion seen in 2014, but down considerably from the $13.7 billion estimated for 2008. What growth has been experienced in recent years has been driven by online betting, which itself has risen from 10% of all betting 11 years ago to 33% today.

One area that could be promising for Derby Games is partnering up with other companies in the space, like it has done with rival Xpressbet. This is a common strategy in the industry. In the sports gambling space, DraftKings eventually partnered with Caesars to help its expansion into 12 states. FanDuel partnered with Boyd Gaming to do the same. These arrangements can take the form of equity or revenue-sharing deals that benefit large and small industry players.

Terms of the Deal

There’s no doubt that the management team at Derby Games has done well growing the company, but a part of this is due to their access to capital. Prior to the current capital round it is looking to close, it raised $6.1 million in Series A funding. This current raise is targeted to get the company up to $1.07 million in capital with a minimum target of $25,000. As of this writing, the SAFE note the firm is using specifies a $10 million valuation cap, but after October 15th this will increase to $11 million. Investors in the company do get a 20% discount upon the next raise, subject to the valuation cap. Also worth mentioning is the fact that the minimum investment per person is set at only $50. This leaves the door open for most people to chip in if they deem it appropriate.

A Look at Management

Most companies with millions of dollars in annual sales have several employees, but Derby Games is the exception. Its core team, consists of three individuals: Tom Hessert, the firm’s CEO, Walter Hessert, its CPO (Chief Product Officer), and Eric Gay, the company’s CTO. Prior to working on Derby Games, Tom Hessert was employed by Urban Outfitters. There, he served as a divisional planner who ran e-commerce operations for a $180 million division of urbanoutfitters.com. Tom has a BA from Notre Dame. Walter is the co-founder and Chief Product Officer of the company, and his task, according to the firm, is to make sure the games are fun to play. He also leads business development and new partnerships, and he has a BA from Notre Dame. Eric, meanwhile, has over 15 years of experience building and leading technology teams. He has held various senior positions, including at RollingStone.com and Spring Street Networks. At Derby Games, Eric oversees all development and leads new integration efforts. He has a B.S. in Computer Science from Ohio University.

The Rating: Deal To Watch

Derby Games has been rated a “Deal to Watch”. Since its inception, the company has seen remarkable growth and it has a compelling story to tell. Namely, as the gambling industry opens up, not only in the US but across the globe, it aims to capture a piece of that. So far, the business has done well. Last year, even, the firm came in earnings positive and operating cash flow positive. This is excellent for shareholders to see because while growth is important, so too is being able to pay your bills. There are, however, a number of negatives that investors should be cognizant of.

For starters, we have the fact that it is operating in an incredibly competitive space. Not only does the firm have legal tightropes to walk, it has an impressive slate of rivals. These include TwinSpires, TVG, US Racing, its partner Xpressbet, and more. Many of its peers are far larger than it is and while the industry is moving to include more online betting, the space itself has more or less stagnated. Another limitation expressed by management is that, as far as mobile goes, it only operates for iOS devices.

One source calculated that about 70% of online gambling in the US is now done via mobile devices, but to exclude Android is a mistake. Management stated that this is because Google does not allow gambling apps on Google Play, but this is no longer true. Though some may view this criticism as unfair, Android-based devices have a 47.3% market share in North America compared to the 52.3% for iOS devices. If Derby Games ever hopes to expand abroad, this will become even more important. After all, on the global scale, iOS has a market share of just 22.9% compared to 74.5% seen for Android.

There are other issues as well, like sales not growing in 2018 compared to 2017, but isn’t the largest concern. That’s reserved for the company’s capital structure. As of the end of its 2018 fiscal year, the company had debt of $2.144 million on its books. This is on top of nearly $2.50 million in convertible notes and a further $315,447 worth of accrued interest. This $2.144 million in debt carries an 11.5% annual interest rate. This works out to nearly $247k in interest expense, none of which was factored into its income statement for its 2018 fiscal year. On top of this high amount of leverage, the firm has the following risk outlined in its Form C Filing:

What this means is that until this non-convertible debt is paid off, the business may not touch the proceeds of its offering. It has a narrow window of only 6 months following the close of this current capital raise to either pay its debt down or get the covenant changed. Otherwise, its investors will be given their money back. From the proceeds of its offering, the company intends to allocate $149,800 toward debt repayment. This will save the firm annual interest expense of $17,227. But this is only a drop in the bucket compared to what needs to be covered. Likely, this means another raise will be needed before long. The collateralized nature of its assets also paves the way for all sorts of adverse incentives from its lenders.

The performance of Derby Games since its inception speaks for itself. The company is an interesting prospect for investors to consider, but as this research report outlines, there are risks to keep in mind. These risks aren’t great enough to offset what management has accomplished, but they are enough to prevent this from being considered a Top Deal.