Grady's Cold Brew

New Orleans–Style Cold Brew

Overview

Raised: $1,069,907

Rolling Commitments ($USD)

03/30/2021

$2,252

1,262

2019

Food, Beverage, & Restaurants

Non-Tech

B2B/B2C

High

High

Summary Profit and Loss Statement

| Most Recent Year | Prior Year | |

|---|---|---|

|

Revenue |

$3,896,701 |

$3,647,718 |

|

COGS |

$2,226,329 |

$2,014,995 |

|

Tax |

$0 |

$0 |

| ||

| ||

|

Net Income |

$-957,618 |

$-558,039 |

Summary Balance Sheet

| Most Recent Year | Prior Year | |

|---|---|---|

|

Cash |

$132,574 |

$416,366 |

|

Accounts Receivable |

$292,841 |

$318,153 |

|

Total Assets |

$1,246,284 |

$1,806,961 |

|

Short-Term Debt |

$825,929 |

$372,026 |

|

Long-Term Debt |

$748,237 |

$806,198 |

|

Total Liabilities |

$1,574,166 |

$1,178,224 |

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

Grady’s Cold Brew has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

Coffee has been a major part of society for centuries. The first confirmed historical references to its consumption date back to 15th Century Ethiopia. Actual use of the commodity, though, may go back to the 9th Century or earlier. Today, it’s one of the most consumed beverages on the planet, with 165.3 million 60-kg bags worth of the seed sold every year. Though one might expect coffee consumption to plateau eventually, through today that has not been the case. In fact, while some categories of coffee do decline in popularity over time, others see robust growth in return. The latest trend in the ebb and flow of consumption has propelled an unlikely variant of the product to great heights: cold brew. Once a minor niche in the world of coffee, cold brew has been catching fire. If forecasts are accurate, the picture for the companies selling it should be attractive for years to come. Now, with crowd raising a reality, investors have the opportunity to buy in to one of the early movers in the space. It will cost you more than most any cup of coffee, but if the company can continue growing, it may well be worth it.

Problem

Cold brew is in high demand. That’s an indisputable fact. For most lovers of this variant, the go-to way to satisfy their thirst is to stop at a local coffee shop, but this has its downsides. The wait to get the drink is one issue, but perhaps a bigger one is the several dollars a customer might have to dole out to satiate their desire. Over time, this cost can add up. In fact, the average American spends about $1,100 per year on coffee. One way to cut costs is to brew the drink at home, but this is a challenge. Unlike your pot of hot coffee, which can brew in minutes, cold brew takes a while to prepare. Some sources suggest steeping the coffee for up to 12 hours (though Starbucks steeps its coffee for 20 hours), and then refrigerating it for another 18 to 24 hours before drinking it.

Solution

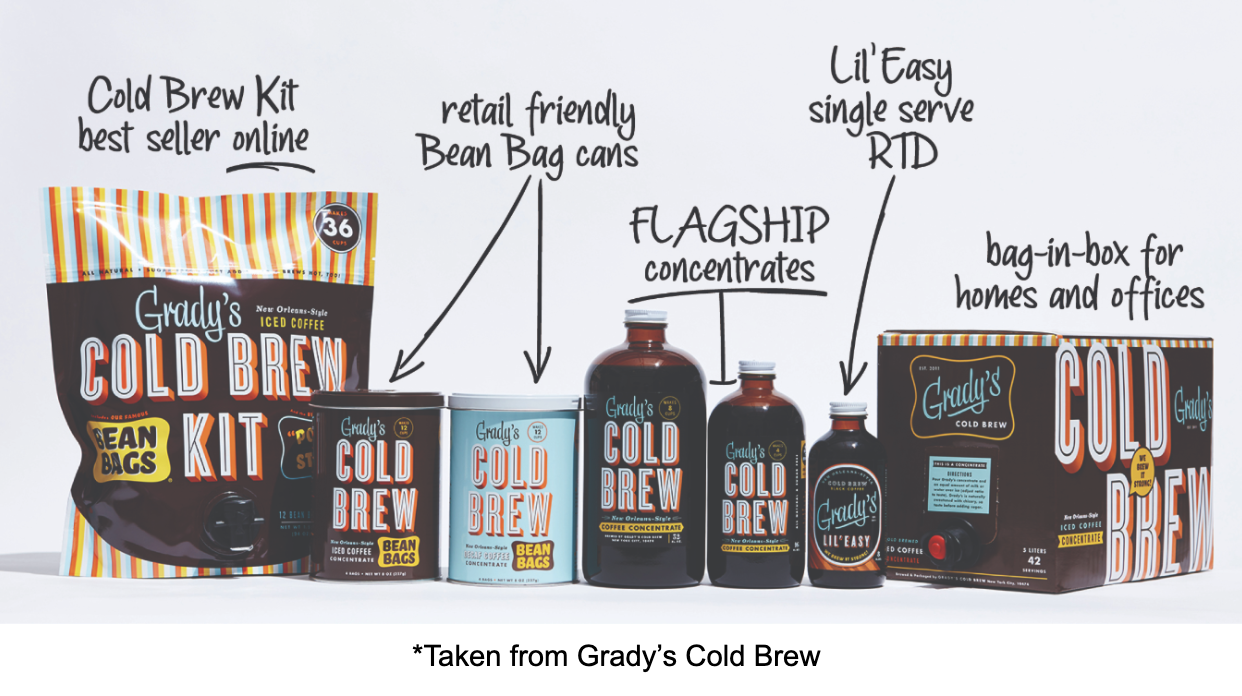

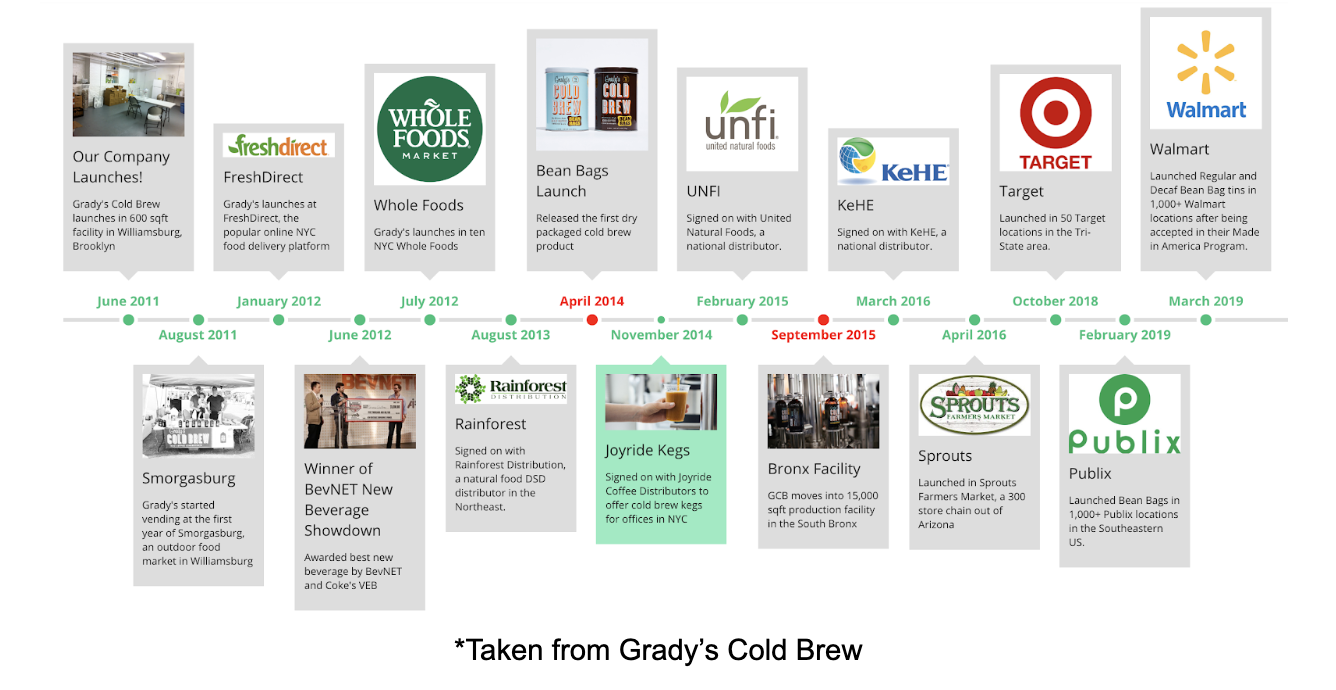

To address these shortcomings of cold brew and to capitalize on the growing cold brew trend, founders Grady Laird and Dave Sands joined together to build Grady’s Cold Brew. The company’s flagship product, Gary’s Cold Brew concentrates, was launched following the company’s founding in 2011. From those humble beginnings in a 600 square foot facility in Brooklyn, the company used what revenue it generated to expand. Today, the company sells a wide array of offerings. This includes its original concentrates, Cold Brew Kit Bean Bags, retail-friendly Bean Bag cans, its Lil’ Easy single serve RTD (ready-to-drink) beverages, and its own brand of boxed coffee.

Over time, management has built out a diversified revenue stream for the company. Not just from the angle of different product offerings, but from the perspective of who it sells its coffee to. According to management, 57% of its sales today come from retail partners. A further 29% are DTC (direct-to-consumer) through the company’s website and through its selling arrangement with Amazon. The remaining 14% of sales come from food service providers and corporations. One interesting data point is that its average order through its DTC and Amazon setup comes out to more than $50.

As the image above illustrates, Grady’s has done well to establish itself as a multi-channel brand. This includes by selling to big retailers with global appeal. In October of 2018, the firm got some of its products into 50 Target stores. In February of 2019, it struck an arrangement to get its brand into more than 1,000 Publix locations. A month later it struck a similar deal for more than 1,000 Wal-Mart stores. The company has not disclosed which partner, but it is supposedly conducting an operational test with a major quick service chain. If this goes well, the company believes that it could see a nationwide rollout with that partner next year.

Since its inception, Grady’s has gone on to generate more than $21.5 million in sales. Each year, revenue has come in stronger than the last. According to its latest filings, the company generated revenue in 2017 of $3.65 million. Last year, this grew 6.8% to nearly $3.90 million. This year, management expects for gross sales to exceed $5 million. The firm has not disclosed how this will look on a net sales basis. But given that last year’s gross sales were around $4.5 million, this should translate to net sales of around $4.4 million.

While revenue has done well to grow, the firm’s bottom line has struggled. It generated a net loss in 2017 of $558,039. This nearly doubled to a loss of $957,618 last year. Just as net income worsened, operating cash flow did change materially, due in large part to changes in working capital. Last year, the company’s operating cash flow totaled -$222,227, which was far better than the –$911,463 in outflows seen in 2017. Despite these losses and outflows, one positive thing for investors to keep in mind is that net debt really isn’t too high. As of the end of its 2018 fiscal year, net debt stood at $615,663. This excludes $315,655 in current credit card liabilities. In all, the company’s liabilities don’t have extraordinarily high interest rates. All of its interest rates range between 0% and 13.5%, with the exception of $57,925. This particular liability falls under the company’s credit card category and carries an annualized rate of 29.99%.

A Fast-Growing Space

The niche that Grady’s falls under is fairly decent in size these days, and it’s growing at a quick pace. According to one source, retail sales of coffee and RTD stood at $14.6 billion in 2017. This implied a 5.9% annualized growth rate from 2012. By 2022, this category is expected to rise to about $18 billion. Another source indicated that retail sales last year totaled $15.1 billion and that by 2024 (with a CAGR of 4.2%), the space should hit $18.5 billion. It is worth mentioning, though, that not all coffee categories are created the same.

In the 10 years ending in 2017, sales of both ground and whole bean coffee flatlined, while RTD and iced beverage sales heated up. On the iced beverage front, for instance, sales in 2018 were estimated to total $10.4 billion. This represented a 7.3% growth over the prior year, while hot coffee sales had risen only 4.6% over the same timeframe. That same source indicated that iced coffee demand should rise a further 6.6% in 2020, taking it to nearly $11.1 billion.

Cold brew coffee specifically is a bit smaller. A different source suggests that global demand for the drink will rise to $1.63 billion by 2025. Though this may seem small compared to the rest of the iced beverage space, the annualized growth rate is impressive. It is currently projected to be about 25.1% during this window of time. While the US is and will remain the largest market for cold brew for the foreseeable future, Asia/Pacific’s annual growth rate of 29.4% should eclipse any other major markets. So popular is iced coffee these days that a full 36% of consumers surveyed said that they will even continue drinking it through the winter.

One other positive for Grady’s is the fact that private label coffee still dominates the market in the single cup category. This fits in nicely with the firm’s RTD offering. Private label brands held a robust 22.6% share of the market in the US last year, plus they saw an aggregate growth rate of 11.4%. Starbucks, by comparison, controlled only 16.7% of the market and saw a rather slow growth rate by comparison at 4.3%. That said, Starbucks does still dominate the overall RTD market with a share of 36.2%, while its share of the RTD cappuccino/iced coffee space stands at 63.9%.

Terms of the Deal

The transaction being sought by the management team at Grady’s is simple and straightforward. In exchange for capital, the company is selling Class B Common Shares of itself to the public. Shares are going for only $1.18 apiece, but the minimum required for each participant is $299.72, or 254 shares. The company is trying to raise up to $1.07 million, but it can close as low as $9,999.32. As of this writing, investors have contributed $174,085 to the deal, with a pre-money valuation of almost $12.81 million. Unlike some deals, this raise does involve the holders of the Class B units receiving voting rights attached to them. But these are, for all intents and purposes, irrelevant because the Class B investors don’t have as much of a vote as the Class A holders do.

An Eye on Management

Though Grady’s has gone on to have a meaningful number of employees, two individuals stand at the top of the firm: Grady Laird and Dave Sands. Laird serves as the company’s Co-Founder, President, and CEO. He also considers himself a cook, editor, and writer. In the past, he accumulated 10 years of experience as a production editor for magazines. These included GQ, Men’s Vogue, Details, Harper’s Bazaar, and Condé Nast Traveler. He holds a BA in Journalism with an emphasis in Advertising from the University of Missouri–Columbia. Sands, meanwhile, is Grady’s other Co-Founder, as well as its Director of Sales. Before devoting his full attention to being a jack-of-all-trades at Grady’s (sales director, brewery builder, truck driver, etc…), Dave spent five years at Xerox Corporation. He began there in entry level sales. He eventually would up managing their new Office Services Division for all IPG & WPP accounts, worldwide. Dave has been named to the Forbes 30-under-30 list, and was featured in a national Wired Magazine & Jack Daniels advertising campaign. He has also made appearances in Bustle, Bloomberg, Entrepreneur, and Runner’s World.

The Rating: Deal To Watch

After careful consideration, Grady’s has been rated a “Deal To Watch”. Undoubtedly, the company has done well to not just establish its own quality brand, but to grow in a rather competitive market. This, combined with continued sales growth for the company and a forecast for even more sales growth in the industry in which it operates, is incredibly encouraging. At first glance, the $12.81 million valuation being sought after by management appears cheap. However, the firm’s bottom line is disconcerting. To see continued losses and cash outflows, even after the company has been around for nearly a decade, is not particularly great. Yes, the firm can and should receive slack. This is because it is growing and working to establish itself as a major player in this hot market, but at some point it must generate a profit.

Assuming the firm raises the full $1.07 million it is after, it believes that it can have enough runway for another 24 months. But what management really needs to do is reach toward cash flow neutrality. At some point, continued sales growth is likely to move it in that direction, but the question always comes down to timing. On the plus side, debt is quite low, all things considered. That should help to reduce risks considerably. Added together, all of this paints a picture of an attractive prospect that has excellent long-term potential. Risks, though, are present. Investors would be wise to keep these issues in mind. Having said that, if management can edge more toward cash flow neutrality over the next two years or so, it could be an excellent long-term prospect to have a piece of.