Hundy

P2P Microloans for America's New Middle Class

Overview

Raised: $107,000

Rolling Commitments ($USD)

12/07/2019

$1,338

263

2016

Financial & Insurance Products & Services

Fintech

Miami, Florida

Raise History

| Offering Name | Close Date | Platform | Valuation/Cap | Total Raised | Security Type | Status | Reg Type |

|---|---|---|---|---|---|---|---|

| Hundy | 07/26/2021 | StartEngine | $5,750,000 | $96,798 | Convertible Note | Funded | RegCF |

| Hundy | 12/15/2020 | StartEngine | $5,500,000 | $136,375 | Convertible Note | Funded | RegCF |

| Hundy | 11/29/2019 | StartEngine | $4,000,000 | $107,000 | Convertible Note | Funded | RegCF |

Price per Share History

Note: Share prices shown in earlier rounds may not be indicative of any stock splits.

Valuation History

Revenue History

Note: Revenue data points reflect the latest of either the most recent fiscal year's financials, or updated revenues directly from the founder, at each raise's close date.

Employee History

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

The Hundy team has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

Hundy is a P2P (peer-to-peer) lending platform set up to give micro loans to its customer base. Set up in response to a hole in the market, the company believes it can become a major player, not only in response to the firm’s plugging of said hole, but because of how it plans to do so.

With its unique business model and with some early traction so far, the company offers prospective investors with a chance to jump into a large and fast-growing industry and, though the road to profitability is likely long, to grab ahold of upside along the way.

Problem

Today, nearly half of Americans in the US have severe financial issues, being individually unable to cover an unexpected and sudden expense of $400 or more. In all, Americans owe $1.04 trillion in credit card debt, and while 40% of Americans are capable of paying their entire credit card balance in full every month (where the average nationwide is $6,354), the other 60% cannot.

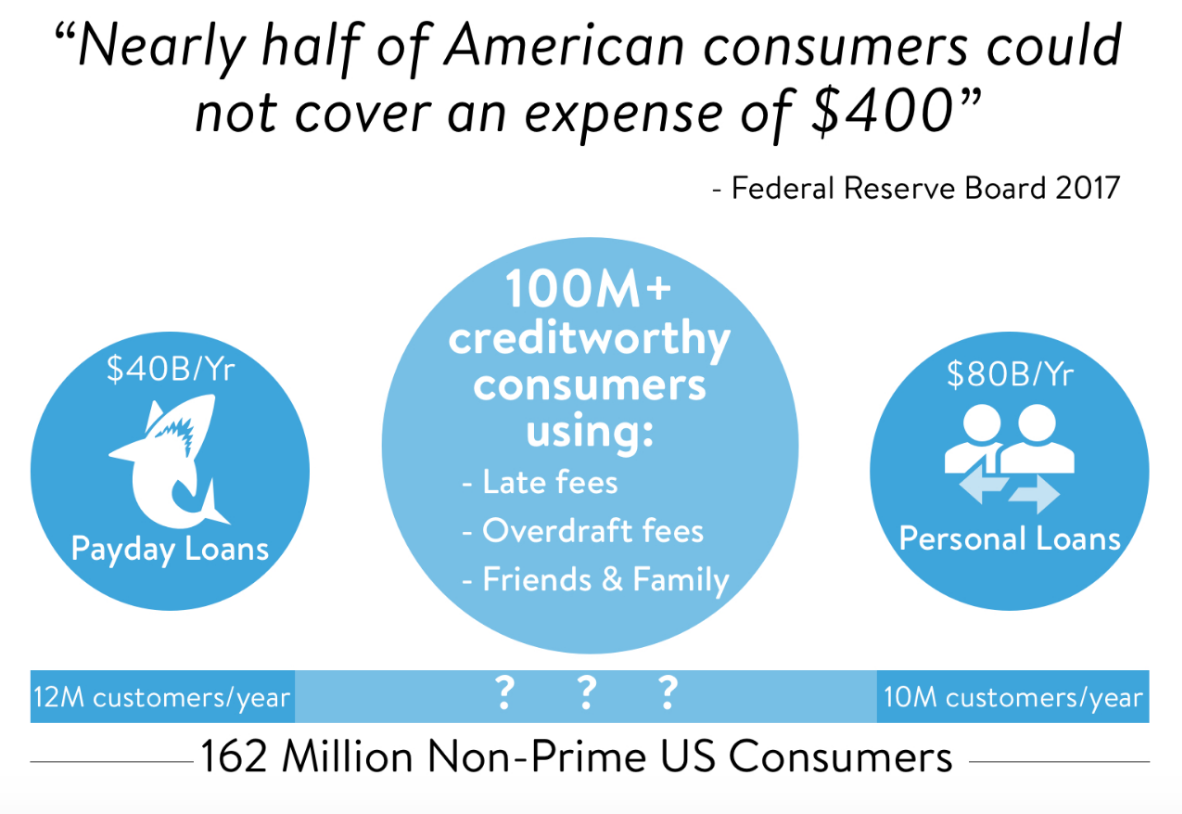

This mix of being cash-poor and credit-leveraged creates a problem for a large swath of Americans. Of the 162 million who were non-prime rated in 2017, the top 10 million tapped the personal loan market, while the bottom 12 million tapped the $80 billion-per-year payday lending space. This left well over 100 million non-prime, but credit-worthy consumers across the US having to fall back on using late fees, overdraft fees, and friends and family members, when applicable, to cover shortfalls.

Solution

Enter Hundy, a mobile app and social network aimed at solving the lending needs of a large swath of Americans. According to management, the firm was set up to provide what it calls micro loans, which it pegs as loans of up to $250, to its user base. Any loans taken out will be made available to the borrowers within one business day and they have, initially, 31 days to pay it back. Each loan is also given a 60-day grace period, during which time additional interest is charged, but at a lower rate than what the company charges during the first 31 days. For the first 31 days a loan is outstanding, the APR is 177%, but during the grace period this is expected to drop to 60%. The company hopes to bring loan costs down over time.

To start with, consumers won’t be able to borrow $250. They can borrow in $50 increments, and as they prove themselves able and willing to pay the amount borrowed back, they will be able to increase their borrowing limit. Each time somebody successfully pays a loan back, they will receive points giving them discounts on their loans and lenders will receive points that can be used toward boosting their ROI (return on investment) on loans they decide to give out to community members.

As of this writing, Hundy is only available in California, but the results there have been encouraging. The company has 150,587 copies of its app downloaded. It has 125,000 users on its nationwide waitlist, 600 active borrowers (defined as somebody who has taken out a loan over the past year, with the average user taking on 4 loans per annum), and a customer retention rate, excluding charge-offs, of 97%. In the month of June alone, the company brought in revenue of $3,309, and this figure is growing at a rate of about 10% per month. A total of more than 3,500 loans have been originated on the company’s platform, with total loan volume of $350,000, and the default rate on these loans so far is about 6.6%.

Moving forward, management has big plans. In the first quarter of 2020, it hopes to begin expanding into the Florida market, which it has identified as fertile ground for its services. Ultimately, the firm intends to push nationwide, but geographic expansion isn’t its only objective. In addition to expanding in this manner, the company hopes to increase its revenue stream through future feature rollouts like its friend-to-friend lending option that’s currently in beta, and by moving beyond a pool of accredited investors lending out the money to also permit investors who are not accredited to participate.

In terms of customer focus, management has a pretty good idea who it is aiming for. Its ideal borrower, for instance, is a user whose FICO is between 580 and 680 and who makes between $25,000 and $75,000 per year. Its ideal investor who will make capital available to borrowers will make $100,000 or more per year, and will have a FICO in excess of 700.

Large Market Opportunity

At this time, the overall market opportunity for Hundy is significant in size. According to one source, last year the total personal loan industry was $138 billion in size in the US alone. This represented an increase over the $56 billion in size seen just five years earlier. In all, there were 21.1 million personal loans outstanding in 2018 compared to 176 million credit cards, and personal loans accounted for only 0.9% of outstanding consumer debt. For comparison’s sake, $1.02 trillion is borrowed through credit cards.

Part of the reason why the personal loan space is so small compared to credit cards might be due to the fact that the average APR is 33.4% and that, unlike credit cards, which are readily available, there is no easy way to immediately get personal loan borrowings at a moment’s notice. That said, FinTech firms like Hundy are changing this. According to one source, FinTech companies accounted for 38% of the $138 billion in loans recorded for 2018. This was up from only 5% five years earlier. According to Lending Club, one of the largest P2P lenders in the market today, the estimated potential immediate addressable market opportunity in this space exceeds $445 billion.

Delinquency rates associated with personal loans are higher than most other forms of lending at 3.63%, but as might be expected (and as illustrated in the image above), the delinquency rate is heavily tilted toward the younger generations. Given the tech-savvy nature of Hundy’s offering, a higher delinquency rate (and, therefore, its relatively high default rate of 6.6%) should be expected.

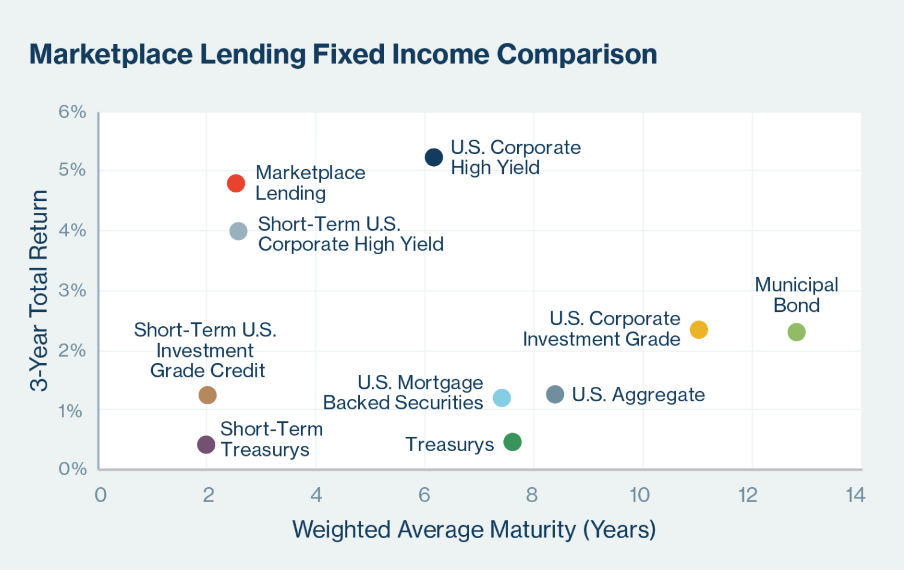

Even though delinquency rates and default rates are higher for personal loans compared to other options out there, the returns for investors are larger as well. In the image above, you can see that, with the exception of US corporate high-yield debt, personal loans through a marketplace format offer the highest three-year total returns of a variety of debt security options available. In fact, the median return for loans that are between 12 and 18 months long comes out to around 4.4%, with 80% of personal loans issued covering that time period ranging between a return of 2.2% and 6.6%. Also, as the image below illustrates, the APR assigned to loans varies materially based on FICO, so one way the company can control its investors’ returns is by controlling who can and who cannot receive a loan through its portal.

This is something that Lending Club, one of Hundy’s biggest competitors, has learned over the years. As the image below illustrates, the company has, in recent years, quickly shifted its focus away from low-grade loans and toward high-grade ones. This is most apparent when looking at the company’s Grade A loans, which are considered the highest-quality. The charge-off rate of those loans is only 2.4%, compared to 5.7% for the Grade B loans on its platform, and compared to the weighted-average 10.2% of all such loans on its platform. Between 2013 and 2018, the company managed to shift its Grade A loan exposure up from 13.7% to 32%.

Despite this transition, and despite the company’s scale (the latter made clear when you consider that the business was servicing loans worth $14.8 billion as of the end of its latest quarter, a number that’s up 18% year-over-year, and that earlier this year it celebrated its 3 millionth borrower), it still has difficulty generating a profit. Adjusted profits (non-GAAP) this year are forecasted to be between -$29 million and -$9 million.

Though for investors in a startup like Hundy, these facts might be disconcerting, Hundy does have some things going for it that might make the road to profitability easier. For starters, there’s the fact that the overwhelming majority of consumers don’t think about things from the perspective of interest rates but, rather, they pay attention to actual dollars. Paying $3 to borrow $50 for a month doesn’t seem like much, even though it represents an annualized rate of 72%, but paying $100 to borrow $2,000 for the same period of time at an implied rate of 60% per annum may seem a bridge too far. Hundy’s entire focus is on micro loans, where small dollar amounts may not cause borrowers in need to balk. For Lending Club, as well as most of the major players out there, the typical minimum that can be borrowed is $1,000.

This brings us to the matter of interest rate charged. The initial rate of 177% per annum that’s charged by Hundy is awfully painful. This is especially true when you consider that the range currently charged by Lending Club is between 6.95% and 35.89%, with an average 36-month loans coming out to 11.42% and an average for 60-month loans totaling 14.25%. Between the origination fees of between 1% and 6% charged by Lending Club, and the periodic default of loans, the actual returns realized by the investors on the company’s platform range between 1.6% and 7.5%.

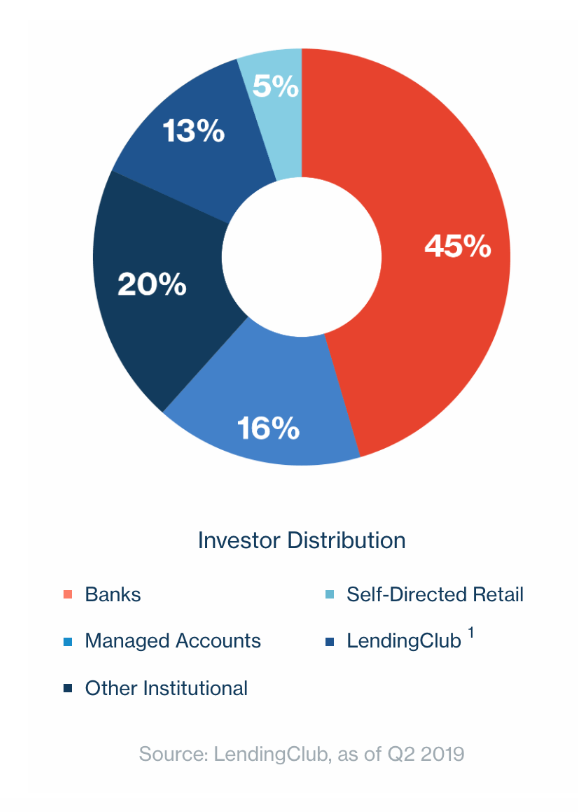

By charging a higher return for its borrowers, Hundy should be able to see to it that its users, on average, post more attractive returns too. It’s in part because of the low returns on Lending Club’s platform that only 5% of the company’s originated loans are provided by self-directed investors compared to the 45% that have been provided by banks. The rest, meanwhile, are provided through managed accounts, other institutions, and the company itself. Charging more, especially when your unique approach positions you in an underserved niche, can permit for potentially greater returns and draw more users in, but ultimately utilizing banks and other third-parties will probably become important for Hundy.

Terms of the Deal

The terms of this transaction are not complex, but they are detailed. In exchange for an investment, investors will receive convertible promissory notes in the company that will be convertible (subject to a $1.5 million conversion trigger) into common shares of the enterprise. These notes will convert at a 10% discount to the valuation of the business upon its next equity raise, but with a valuation cap of $4 million. All investors will receive a base interest rate of 12% per annum, but early investors will receive interest hikes taking the annualized rate as high as 14.4%. All notes in this raise have a maturity of September 4th, 2020.

In all, management is seeking to raise between $10,000 and $107,000 in this transaction. The lower range would allow limited operations to persist, perhaps for as short as a month into the future, while the high end would permit the business the ability to operate for up to five months. The goal, management said, is to almost immediately come out with another crowd raise, tapping into between another $500,000 and up to the full $1.07 million it is permitted to in any given year.

An Eye On Management

The management team and overall network of individuals associated with Hundy is impressive. In addition to several advisors and a lead iOS developer, the company has two core members of its team. The first of these is founder, CEO, and Director Pete Budlong. Budlong is a three-time entrepreneur who has over two decades of experience working on online marketplaces and on mobile advertising platforms. He was on the founding team and led business development at Classifieds2000, which was later acquired by Excite. He later co-founded Soundflavor (acquired by Ricall), a digital marketplace focused on music discovery and, in 2016, he founded Hundy. The other key figure in the firm is co-founder and VP of Engineering, Ram Hegde. Hegde has a solid track record of building great engineering teams and delivering innovative solutions in mobile, consumer internet, and open-source software. Previously, he co-founded Clef Software, which delivered educational apps with over 500k installs. Ram’s experience ranges from start-ups to large technology companies including Nokia and Intel.

The Rating: Deal To Watch

Based upon the data provided and our own market research, we have decided to rate Hundy a “Deal To Watch”. This places the firm in the top 10% to 20% of companies we analyze. This rating can be justified by a number of factors, including the founding team’s past experiences, but also because of the traction the business has seen so far. Already generating revenue, with a large and growing waitlist, and the opportunity to expand nationwide in the years to come, the company has done well, as early-stage as it is, to prove out its model. Questions circulate around what kind of interest rates are sustainable, and if the company’s micro-oriented business model will allow it to generate a profit in a space where big players are still struggling. This adds in a significant question about risk.

So long as Hundy is in its growth phase, the firm will likely struggle to capture profits, and then there’s the question, because of this, of how much additional capital it might need to raise moving forward. Large capital raises or a high number of small ones will help to boost growth, but at the cost of diluting existing shareholders. Add to this the state-to-state regulatory burdens it must inevitably deal with and the fact that any of its non-micro competitors could always step into the space when they have a far larger footprint than it does, offer loans at lower interest rates, and it’s not hard to imagine a scenario of the company being priced out of the market. That said, if the firm can establish a meaningful user base quick enough, given the network effects and social aspects the business offers, it could insulate itself from these risks, and between that and the greater impact FinTech platforms are having on this space, the business has a decent chance of success.