Hylete

Fitness Lifestyle Brand Community Built, Backed, and Driven

Overview

Raised: $1,069,701

Rolling Commitments ($USD)

02/29/2020

$11,380

1,225

2012

Education, Training, & Coaching

Non-Tech

Solana Beach, California

Raise History

| Offering Name | Close Date | Platform | Valuation/Cap | Total Raised | Security Type | Status | Reg Type |

|---|---|---|---|---|---|---|---|

| Hylete | 12/20/2022 | StartEngine | $27,379,991 | $159,125 | Equity - Preferred | Not Funded | RegCF |

| Hylete | 03/02/2021 | StartEngine | $48,800,000 | $1,433,172 | Equity - Common | Funded | RegA+ |

| Hylete | 02/16/2020 | StartEngine | $30,400,000 | $1,069,701 | Equity - Common | Funded | RegCF |

| Hylete | 04/27/2017 | StartEngine | - | $1,000,000 | Equity - Common | Funded | RegCF |

Price per Share History

Note: Share prices shown in earlier rounds may not be indicative of any stock splits.

Valuation History

Revenue History

Note: Revenue data points reflect the latest of either the most recent fiscal year's financials, or updated revenues directly from the founder, at each raise's close date.

Employee History

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

The HYLETE team has been selected as a “Underweighted Deal” by KingsCrowd. This distinction is reserved for deals not selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

The athletic wear market is large, but growing slowly. Even with that slow growth though, the space is fickle. This leads to significant opportunities for the firms that best distinguish themselves in investors’ eyes. Over night, small players can amass a tremendous following that will propel sales higher. In this space, catching that upside is half the battle, and that’s what the management team at HYLETE is banking on. With a track record of sales to back up its diverse product lines, the company believes it can continue expanding. In time, the goal is to join the ranks of similar firms that are trading on the public markets.

Problem

The athletic wear space is large but hard to please. As with anything tied to the fashion industry, one day a brand can be a high-flyer, and the next it’s seeing sales plummet. Few companies that have anything to do with clothes or similar products have demonstrated true staying power. Part of this challenge relates to personal tastes and how those change, but the other issue ties in to one simple fact: everybody is different. What works for some consumers doesn’t work or feel right for others. This serves as a point of frustration for consumers whose needs remain unmet. But it opens up doors of opportunity for the companies/brands who can cater to them.

Solution

Enter HYLETE. Founded in 2012 on the idea of a single pair of shorts, the brand has exploded over time. Today, the company sells a variety of athletic wear through its DTC (direct-to-consumer) business channels. Examples include the firm’s Circuit Cross-Training Shoe, its Iris Short, its Nimbus Collection, and its Flexion Collection. The Circuit Cross-Training Shoe operates as a three-in-one shoe that has uses ranging from running to lifting. The company achieves this by including three interchangeable insoles in the shoes that consumers can swap out as needed. Its Iris Short, meanwhile, is a product marketed specifically to women. Its breathable mesh liner helps to support movement and ensures that the short doesn’t ride up like other brands do. The Nimbus Collection includes a line that can double as a capri or a tight (or both simultaneously), depending on the user’s preferences. Its Flexion Collection is designed to help regulate an athlete’s body temperature. HYLETE also offers backpacks, including a 6-in-1 version perfect for everything from work to travel, and it offers a line of athletic shoes.

The monetization strategy for the company is simple: it sells its clothing to the individuals who visit its website. Though for a startup this audience might seem small, it’s anything but that. The company claims to have over 248,000 “loyal customers”, 25,000 of whom are certified fitness experts. By partnering with organizations like the NASM, AFAA, JYM, and LIFE TIME Academy, the company furthers its reach. To give back to the community, while also spreading its appeal, it donates 1% of all women’s apparel sales to the GRACEDBYGRIT foundation. This organization provides scholarships to women participating in sports at the collegiate level. What is a truly good way to give back doubles as a form of cheap advertising as well.

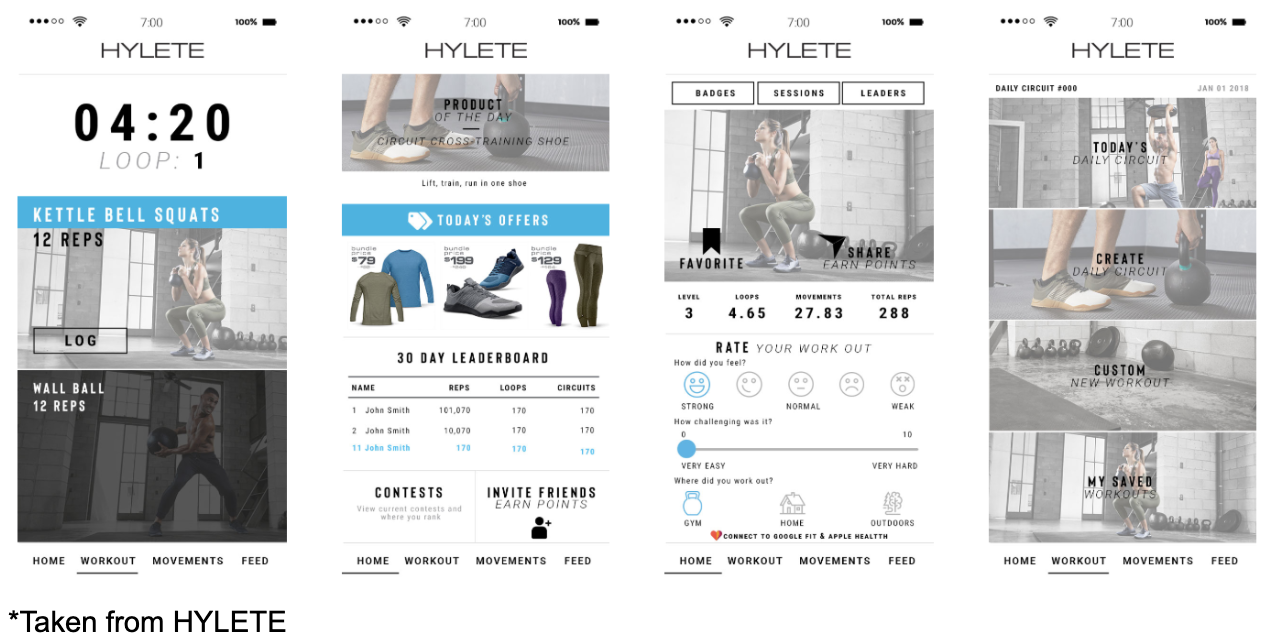

To further its expansion, the management team at HYLETE has some other initiatives currently in the works. The first of these is its Daily Circuit App 2.0. The app’s aim is to help users keep track of and work on their workout routines. Details on monetization around it are unclear. However, it is currently in development while the first incarnation of the app is available for download for free. The company is also working to open its first Experiential Retail Meets Fitness physical storefront sometime in 2021.

Since launching its first product in 2013, HYLETE has gone on to achieve rapid growth and consumer adoption. Last year, revenue at the firm totaled $11.69 million. This represents an increase of 33.2% over the $8.77 million in sales the company generated in 2017. This kind of expansion is impressive, but there’s a major issue the company is dealing with: significant losses. Startup investors expect the companies they are buying into to report losses for a period of time. This is normal and it’s fine. What matters most in the early days of firms is finding a viable customer base and achieving scale. At some point, though, the company must start generating a profit and it must also be able to achieve a healthy balance sheet. This is where HYLETE falls woefully short.

Despite seeing sales soar from 2017 to 2018, the company’s net loss widened significantly. In 2017, HYLETE’s net loss totaled $3.83 million. In 2018, this grew to a loss of $5.65 million. It would be one thing if this loss were non-cash in nature, caused by items like DD&A or stock-based compensation, but that’s not the case here. We can see this by looking at operating cash flow. In 2017, the metric was -$1.81 million. By 2018, it grew to -$4.41 million. As earnings and cash flow figures tank, it becomes necessary for the firm in question to bring in new cash in order to stay alive. That is why, since its first raise years ago, the company has completed six others. This current raise will make number eight, bringing the company cash proceeds of about $10.8 million. It’s important though to keep in mind that not all cash is equal.

When looking at HYLETE’s balance sheet, there are two big pain points: debt and preferred equity. On the debt side, HYLETE is plagued with commitments of $6.24 million. Of this, $4.75 million is classified under current liabilities. This means that, as of the end of last year, the company has about 12 months, maybe less, to pay this debt down or to refinance it. To put this in perspective, its cash and cash equivalents at the end of last year were only $1.47 million. The situation more recently is even worse. According to HYLETE’s Form C filing, its indebtedness has soared to over $10 million, and $8.04 million of that is due December 31st of 2019. Interest rate on its debts range between a not-unreasonable 10% and a high of 18% per annum. A recent promissory note, issued in August of this year and due in December, carries an annual interest rate of 20%.

The other side of the equation is preferred stock. In exchange for capital, the company has issued to investors preferred stock worth $6.92 million. This is spread across three different series, all of which bear the same terms. The preferred units are convertible into common at any point in time, but the real problem here is that the holders really have no incentive to do so. This is because the preferred units are entitled to a 12% dividend per annum. What does not get paid (and management is not paying it) gets accrued and added to the company’s list of other obligations to deal with in the future. This in particular should incense some shareholders. The preferred units’ existence is a case of some shareholders eating away at the value that should be shared with common shareholders. So much for investing to grow a company together.

What’s also damaging here is that the company is being gobbled up from within. The investor who gave the company its $300,000 promissory note that bears a 20% annualized interest rate is also James Caccavo. Not only is he a Director of the company, he, through Steelpoint Co-Investment Fund, owns around 26% of the equity in the enterprise. So bad is the fundamental side of the equation that in its filing the company said that if it only raises its minimum of $10,000, it will only be able to survive through the first quarter of 2020. That assumes, management stipulated that current access to funding sources remain in place. By comparison, management has stated that it does not expect to be EBITDA positive until fiscal year 2021. EBITDA, by definition, excludes interest expense. Last year, this figure was $1.37 million and it’s likely to rise more in the years to come. True cash flow neutrality very likely won’t come until at least 2022 or 2023.

A Large, but Slow-Growing Market

The market that HYLETE operates in is simple to understand. It really does boil down to a large and easily-identifiable space: athleticwear and ancillary products. This year, as the image below illustrates, the global market for sports apparel stands at about $180.96 billion. This represents an increase from the $135 billion spent here back in 2012. If analysts’ forecasts are accurate, the market will expand to $207.79 billion by 2025. What’s interesting here is how the growth rate is expected to change moving forward. From 2012 through 2019, the annualized growth rate of the space was about 4.3%. From 2019 through 2025, this is expected to shrink by nearly half to 2.3% per annum.

This does not mean that impressive results cannot be achieved. Though it is currently being investigated at the federal level for its accounting practices, Under Armour has had a remarkable run. From 2014 through 2018, the company’s revenue surged 68.5% from $3.08 billion to $5.19 billion. In its last two fiscal years, it has generated net losses, but these have been due to non-cash items like restructuring and impairment costs. Over the same five-year window, Lululemon has done even better. Between 2014 and 2018, revenue jumped 82.8% from $1.80 billion to $3.29 billion. Its bottom line has fared far better. During the time period looked at, its net income soared 102.4% from $239.03 million to $483.80 million.

These companies are evidence that robust expansion can occur in a large but almost stagnant market. However, the list of companies in this space that have been relegated to the dustbin of history is large. Earlier this year, CBI Insights published a look at recent bankruptcies in retail. Between 2015 and early 2019, they counted 68 firms, and these exclude small players that are similar in size to HYLETE. To be fair, many of these companies had brick-and-mortar elements to them and were not pure-play DTC businesses. On the other hand, with its first Experiential Retail Meets Fitness store planned to launch in 2021, that distinction soon will no longer exist.

Terms of the Deal

The terms of the transaction sought after by the management team at HYLETE are fairly straightforward. The company is seeking a minimum of $10,000, and a maximum of $1.07 million. It is selling shares of its Class A Common Stock at $1 apiece, but in order to participate an investor must pledge at least $500. Most of the proceeds management brings in will tentatively be used toward inventory buildup. However, the company did say that it may decide to use the cash differently. This disclosure is common among startups and it gives management flexibility in how it plans to use its capital. In all, the company is asking potential investors to value the firm at $30.44 million on a pre-money basis.

An Eye on Management

HYLETE’s team is stacked with qualified individuals, but at the top stand two people: Co-Founders Ron Wilson, II and Matt Paulson. Wilson, serves as the company’s CEO and as a Director and Chairman of the Board of the company. He previously founded Jaco Clothing, Kelysus, and 180s, which grew to over $50 million in sales and achieved a ranking of #9 on Inc. Magazine’s 500 fastest growing companies. Wilson is a former Ernst & Young Entrepreneur of the Year National Finalist and a Sports & Fitness Industry Association “Top 25 Leaders in Sporting Goods”. His educational experience is in Industrial and Systems Engineering. Plus he holds an MBA from The Wharton School, University of Pennsylvania. Co-founder Paulson serves as the company’s Vice President, Business Development. Earlier in his career, he co-founded Xtreme Sponge, a cleaning supply company. Before that, he worked as the Director of Sales and Marketing for Jaco Clothing. In addition to an undergraduate degree, he holds an MBA from San Diego State University.

The Rating: Underweight

After careful consideration, KingsCrowd has decided to rate HYLETE as an underweighted opportunity. The company has an excellent management team and its sales performance in recent years has been astronomical. The fact that management began with a single article of clothing and expanded that into a diverse, fast-growing platform with a significant customer following is awesome. The work needed to get from scratch to where they are today must have been significant. What’s more is the fact that if the company can continue growing its sales, it stands a real chance of success. At the end of the day, though, investing isn’t about looking at just the upside. Taking measure of the downside is just as important.

When it comes to downside risk, HYLETE is an interesting firm. The company’s large and growing net losses and negative operating cash flow figures are not confidence-inspiring. Worse is the fact that the business has had to raise (including this raise) over $10 million through several crowd rounds to get where they are today. Even with this current raise, the firm will almost certainly have to take on more investors a year or two from now to keep on growing. The worst part, though, is its balance sheet. HYLETE’s huge net losses have necessitated taking on costly debt and preferred investors. These very things that helped the business early on are hurting it now. Because of this, the prospect of a nasty end for common stockholders is not too difficult to imagine. HYLETE may very well go on to become a major player in its market, but the road there looks difficult and risky.