Natural SunLite

Patented automatic growing system

Overview

Raised: $12,000

Rolling Commitments ($USD)

11/30/2019

$109

34

2018

Farming & Agriculture

North Palm Springs, California

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

As the global population grows and as new markets (like cannabis) open up, the need for cost-efficient, quality lighting targeted at aiding the growth of plants continues to expand. This is especially true of indoor options because of the ability to control the climate when removed from the great outdoors. Over the years, countless firms have stepped up, each offering their own solution(s), and one of the newest of these businesses, Natural SunLite, believes that its time to shine has come.

By designing COB (chip-on-board) lighting, a version of LED aimed at cost-savings for the long haul, and pairing it with an innovative framework that makes the technology easy to use, Natural SunLite plans to raise a modest amount of capital, start selling its products to customers it says are already prepared to buy, and establish itself as an important player in the space. As with any firm seeking to tackle a big market, there are clear challenges ahead for Natural SunLite, but this doesn’t mean the company can’t overcome them.

Problem

The cannabis market is exploding higher, and as the global population grows, so too will the demand not only for it but for various crops as well. To address this market opportunity, and to create consistent, high-quality yields, cannabis producers especially are turning to indoor growing and cultivation.

Though this brings on added costs like facility infrastructure, lighting, and more, the higher yields have proven to be beneficial for major industry players like Canopy Growth Corporation and Aurora Cannabis. Other, far smaller players have also moved in this direction as well.

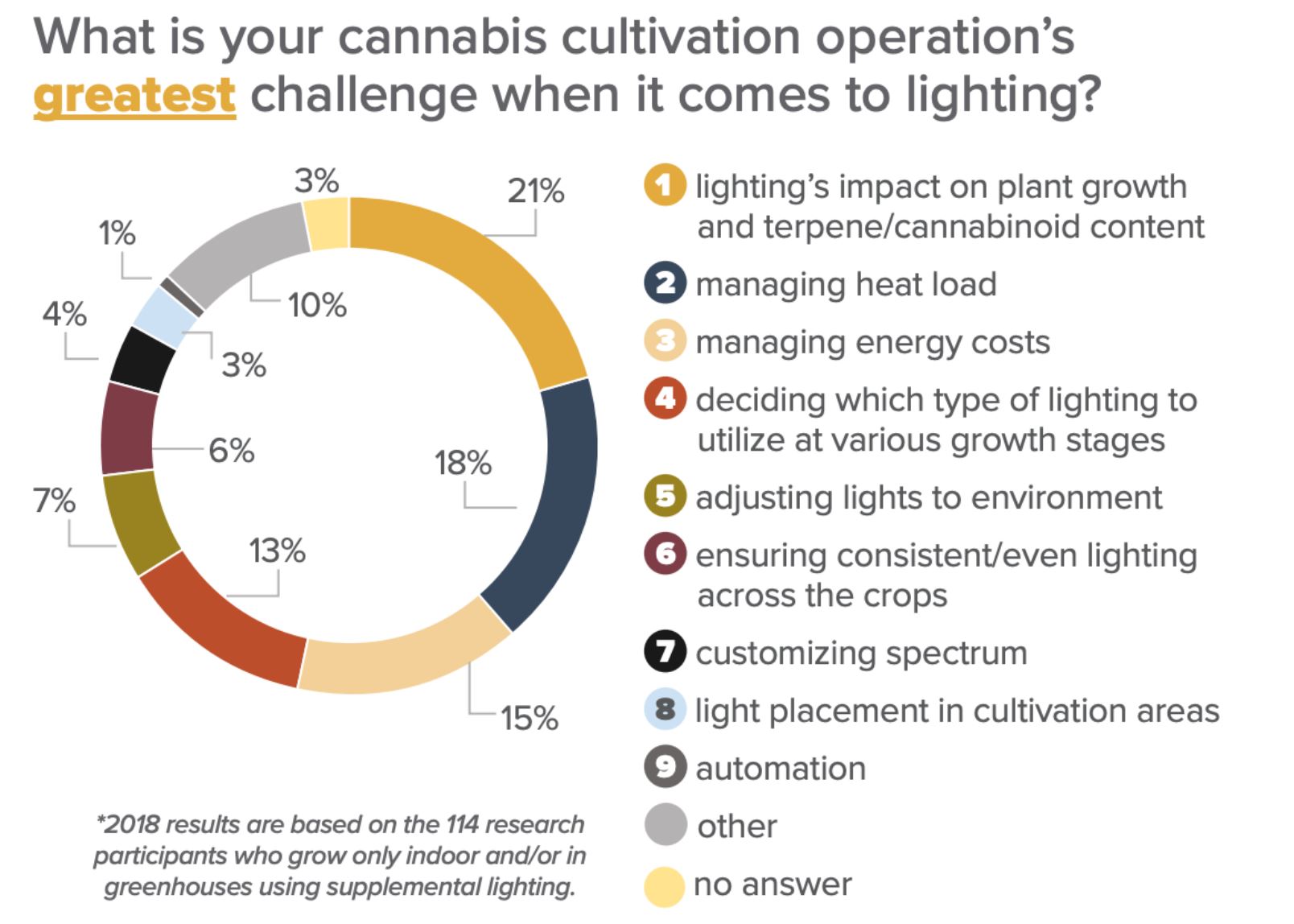

Always, the end goal for growers is to emphasize the right mix of growth results and cost constraints, which is where lighting can be integral to the business equation. Cannabis is considered a light-hungry plant, so cost management is necessary. As you can see in the image above, a report by Cannabis Business Times found that 15% of growers cited managing energy costs as their greatest challenge when it came to lighting. A further 21% listed lighting’s impact on plant growth and terpene / cannabinoid content as their greatest challenge, while 18% listed managing heat load as theirs.

Outside of cannabis, the demand for lighting solutions exists as well. This is especially true in the organic vegetable space but also touches upon some fruits and herbs. Some data places the market for vertical farming, which covers hydroponic growing, aeroponic, and other methods, at about $2.5 billion per year, but this should continue to expand, eventually growing to between $9.9 billion and $13 billion by 2024. The single largest driver for this expansion relates to population growth. As the world becomes more populated, the demand for food will inevitably rise. Vertical farming and just indoor farming, in general, allow crops to be grown more rapidly, often with less water than they would require in the outdoors, and the amount grown (especially since crops can be planted all-year-round in these conditions) and controlled environment ensures less disease and healthier plants.

Natural SunLite explicitly stated this as another key opportunity for them since their lighting solutions can be paired up with any indoor growing methods for which light is integral.

Solution

To address these concerns by growers, the founders of Natural SunLite have worked together to create their own take on indoor lighting. Using COB (chip-on-board) LED solutions (a solid-state lighting technology), the company has created a frame, pictured below, that hangs only several inches above the plants in question.

Each unit is equipped with multiple carbon dioxide dispenser nozzles, a sensor that can detect pH levels, temperature, and humidity, and each unit has a camera that can look at the plants for monitoring purposes. For interested parties, the devices can be monitored and controlled from a mobile device (both iPhone and Android devices through the company’s app).

*Taken from Natural SunLite

This aggregation of technologies permits not only quality lighting, but also creates an opportunity to reduce labor costs. In one scenario, where the company looked at a 20,000 square foot grow facility, it found that its automated system could reduce labor costs 50% or more, with said facility requiring only 7 employees compared to the 18 an identically-sized traditional grower would require. The analysis can be seen in the two tables below.

*Taken from Natural SunLite

A reduction in labor cost isn’t the only benefit for users though. The firm would save a client who ordered an initial 1,000 light system, over an estimated 10-year timeframe, $1.60 million associated with bulb replacements and a further $900,000 on ballast replacement. However, the real benefit comes from a reduction in energy costs.

The company alleges that its patent-pending technology will reduce electricity consumption by around 75% compared to the leading HPS lighting systems currently on the market. For the example provided, and illustrated in the image below, a client would save more than $6.1 million over 10 years, bringing total savings on its solution versus a comparable HPS system to more than $10.5 million.

*Taken from Natural SunLite

One significant negative for customers to digest, though, would be the initial $2 million cost of the system, which is materially higher than the $450,000 cost of an HPS offering. It is also worth mentioning that while the company believes its units should last around 10 years before needing to be replaced, they have decided to offer a generous full warranty for the first eight years.

Another opportunity for shareholders to enjoy, if all goes according to plan, is the revenue that could be generated by the firm’s planned 80,000 square foot “Off-Gridwarehousing space that will be located on 3.5 acres of land between Palm Springs and Desert Hot Springs.

The company intends to lease this space out to growers, offering them the ability to grow their products in a controlled environment and by using no grid-based electricity. The firm intends to accomplish this by hooking said facility up to solar and battery-powered systems.

At this time, management claims to have LOIs (letters of intent) for over 6,600 units, or about 1/3rd of their first year’s projected production. In addition to this, the company has an LOI signed covering 51 countries in Africa, plus it is in talks regarding LOIs for Europe and Canada.

One partner, moving forward, will be Eqcho Capital, which has agreed to both lease out and sell lights on behalf of Natural SunLite, though how attractive this will be for the business is difficult to tell.

Fertile Ground?

*Taken from Cannabis Business Times

For those well-acquainted with the lighting market, it should come as little surprise that a transition from HPS to LED units is taking place. As you can see in the image above and the two images below, lighting preferences from consumers have been shifting and doing so rapidly.

Between 2016 and 2018, LED solutions have grown from representing 21% of lighting in the cannabis growing community to 47% when it came to the propagation stage. For the vegetation phase, it expanded from 17% to 46%, while for the flowering phase it jumped from 15% to 45%.

Over the same period of time, for the vegetation phase, HPS solutions dropped from 31% to 25%, while for flowering they dropped from 62% to 51%. If current trends persist, it will only be a few years before LED options account for nearly all of the lighting utilized by growers.

*Taken from Cannabis Business Times

From a monetary perspective, there is a lot of opportunity here as well. According to Natural SunLite, the indoor grow lights market in the US alone should expand at a rate of 15.7% CAGR between 2015 and 2020, rising from $1.89 billion to $3.92 billion. The larger global hydroponics space, according to management, should grow from $6.93 billion in 2016 to $12.11 billion by 2025, with lettuce accounting for a 32.9% market share.

This is clearly a rapidly-growing niche market, but it doesn’t mean that it’s an easy one to tackle. One competitor on the creation and sale of COB and other lighting options, Luminus Devices, more or less failed spectacularly. After raising around $150 million in venture funding since its founding in 2002, the company, despite generating annual sales of $17 million, was sold off to a subsidiary of Chinese firm San’an in 2013 for only $22 million.

Industrial behemoth, General Electric, exited this market earlier this year, with the sale of Current to American Industrial Partners at an unspecified price, and the firm is working to wind down the rest of its Lighting operations. In short, the space is highly competitive and historically suffers from low margins.

Management

While technology and market strategy are exceedingly important when it comes to a startup’s success (or lack thereof), at least as important as these things are the management team behind it. Natural SunLite is fortunate enough to have a team that, although small, has experience in this domain, but a list of advisors outside of this core team was not available. Specific details pertaining to the team can be seen in the table below.

Deal Terms

The deal being offered to investors in Natural SunLite is relatively straightforward. Management is offering investors the opportunity to come in with a minimum investment of $300 apiece in Class A common shares (the same units management holds). Each share is entitled to one vote and is being priced at $0.50. The minimum raise being sought is $150,000, but the firm is interested in raising up to $1 million. Irrespective of the raise’s size, the pre-money valuation being sought is $20 million which, given the competition in the space, might be considered rich, especially considering that the firm generated no revenue in 2018.

One other important note investors should keep an eye on relates to the financials of the firm. In its filing documents, Natural SunLite lists shareholders equity at over $1 million, driven almost entirely by $1 million in product development costs (aka work in progress). If the firm had paid $1 million to develop its business, this would show up in the cash flows statement, but that’s not the case as the two images below illustrate. Instead, what management did was make an estimate that their patent-pending technology, plus time and energy associated with three years of R&D (research and development), plus copyright to its business plan, are all worth $1 million.

If the company had received an audit, this could only fly if it received a quote from a bonafide third party specialist, but this appears to not have been the case. Since they had a CPA perform only a review instead of an audit, investors should understand that this $1 million in assets (and, therefore, it’s more than $1 million in shareholders equity) could, upon liquidation or upon receiving an actual third-party quote, be worth any random number.

The Rating: Underweight

On the whole, Natural SunLite is an interesting company with an attractive story to tell and a potentially valuable market that it’s tapping. If its patent-pending technology is as good as management alleges, the reason for customers to switch is compelling, but it’s important to keep in mind that customers are already switching away from HPS systems anyway.

It would be more comforting if management were to give details on how its technology competes with other leading LED solutions. In addition, this market is highly-competitive, suffers from low margins (as everything in the lighting market does), and the idea that the firm will have to go on to raise millions more after currently raising money on a lofty valuation exposes investors to the risk of a down-round.

This isn’t to say that there isn’t a good opportunity to be had here though. Combining its technology, as well as other technologies, into the frame management has shown in its offering documents, pairing it up with an app, and making the system automated and easy to control could be a source of attractive value for the right customers. If cost-savings can be garnered here, even compared to other LED solutions, it could have something great going for it, but until more information is revealed, investors should see this transaction as risky.