PlantSnap

PlantSnap -- where nature and technology live in harmony

Overview

Raised: $534,888

Rolling Commitments ($USD)

05/02/2020

$2,815

865

2016

Education, Training, & Coaching

AgriTech

B2B2C

High

Low

Summary Profit and Loss Statement

| Most Recent Year | Prior Year | |

|---|---|---|

|

Revenue |

$2,173,483 |

$191,668 |

|

COGS |

$2,624,941 |

$825,122 |

|

Tax |

$0 |

$0 |

| ||

| ||

|

Net Income |

$-6,790,512 |

$-2,155,979 |

Summary Balance Sheet

| Most Recent Year | Prior Year | |

|---|---|---|

|

Cash |

$360,234 |

$16,277 |

|

Accounts Receivable |

$59,137 |

$153,458 |

|

Total Assets |

$515,694 |

$274,089 |

|

Short-Term Debt |

$8,316,010 |

$1,973,386 |

|

Long-Term Debt |

$118,250 |

$118,250 |

|

Total Liabilities |

$8,434,260 |

$2,091,636 |

Raise History

| Offering Name | Close Date | Platform | Valuation/Cap | Total Raised | Security Type | Status | Reg Type |

|---|---|---|---|---|---|---|---|

| PlantSnap | 04/28/2020 | StartEngine | $33,995,244 | $534,888 | Equity - Common | Funded | RegCF |

| PlantSnap | 04/29/2018 | StartEngine | $23,499,816 | $132,842 | Equity - Common | Funded | RegCF |

| PlantSnap | 02/24/2018 | StartEngine | $9,999,996 | $252,624 | Equity - Common | Funded | RegCF |

| PlantSnap | 09/14/2017 | Wefunder | $5,000,000 | $118,150 | SAFE | Funded | RegCF |

Price per Share History

Note: Share prices shown in earlier rounds may not be indicative of any stock splits.

Valuation History

Revenue History

Note: Revenue data points reflect the latest of either the most recent fiscal year's financials, or updated revenues directly from the founder, at each raise's close date.

Employee History

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

The PlantSnap team has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

Today, there’s an estimated 1,775 botanical gardens spread across 148 countries. Globally, this network receives more than 300 million visits per year. These data points make one fact incredibly clear: a lot of people love plants. To cater to this love, PlantSnap Incorporated was born. The company’s suite of apps (four that are live today) allow users to take photos of plants. The system identifies which plant matches the image, and provides information on it, as well as details about where to shop for it online. Already, PlantSnap has accumulated tens of millions of downloads. Its management team is also working on new iterations of the product that will drive even more revenue for the company moving forward.

Problem

Have you ever seen a plant but had no idea what type it was? Whether it’s poisonous or safe to touch? Where you can buy it for inclusion in your garden? For lovers of the great outdoors, these questions likely pop up a lot. Taking a photo and trying to find a comparable plant online can be tricky. Many of the databases out there today that do recognize plants based on user-submitted photos are limited. At most, they hold 5,000 different plant species.

Solution

The management team at PlantSnap has set out to change this. Through its four different PlantSnap apps, the company allows users to submit photos and have the system compare those photos to more than 250 million images stored on its platform. With a 94% accuracy rate, PlantSnap’s system can identify more than 625,000 different plants. This includes both flowered and non-flowered specimens. It then provides users with valuable information about the specimen in question. In the event that a plant cannot be identified using the company’s system, it can be shared with experts online for the purpose of identification.

Once a plant or flower has been identified, users have the ability to click on the “GET” button. This directs users to the firm’s online directory where it shows them where they can purchase the plants in question. According to management, this feature has not yet been monetized, but it’s not difficult to imagine how the firm might go about this when it so desires. This is especially true when you consider that more than 200,000 users are redirected to the company’s outside sales partners every month. Users can share photos, create and explore on-app plant galleries, communicate with other users, and more. A particularly interesting feature is the ability for users to see on a map where other users have snapped photos and what those photos are. The app also helps users find special gardens and one another when so desired.

Since inception, PlantSnap has seen tremendous success. In 2018, its app was the fifth most downloaded paid app on the App Store. In all, the company has over 32 million downloads to its name and sees more than 500,000 photo uploads per day. On average, the company sees more than 750,000 new installations every month, which will help to fuel revenue growth in the long run. Already, the company’s content has been translated into 37 different languages. This has served to open its platform up to a majority of the world’s population. To help grow its business further, the company has partnered with multiple industry leaders. The list includes the American Public Garden Association, and Botanic Gardens Conservation International. The aforementioned parties encourage their visitors to download and use PlantSnap. These two organizations alone boast 700 million visitors per annum spread across more than 1,200 locations worldwide.

Management has a few ways to monetize the app today. On its freemium service, PlantSnap, it generates revenue through advertising. In the future, it hopes to do the same through monetizing its GET button. On the advertising side, management boasts an eCPM of $3.95, but they did not disclose how much of their sales come from advertising. The company also offers a premium subscription that involves an ad-free experience, provides users with unlimited snaps, allows them to interact with botanists directly. That costs $0.99 per month or $9.99 if paid annually. Users can also pay a one-time $29.99 fee for lifetime access. The company also offers a higher-end premium app called PlantSnap Pro that it charges $12.99 to download.

Outside of its existing portfolio of apps, PlantSnap has some other fun offerings in the pipeline. The next of these to get launched will be an app called MushroomSnap. As the name suggests, MushroomSnap is a mushroom-specific version of the company’s flagship product. Development is completed and the company is just waiting to release it. Another platform in the pipeline is PlantCatch, play on the PokemonGo concept. Users of PlantCatch can go around and ‘capture’ digital plants for their portfolio. Development on this is about 75% complete according to management, with its launch planned for Spring of 2020. The final product announced by the firm is InsectSnap. It centers around the same features that PlantSnap offers, but is geared toward insects instead of plants.

Since its founding, PlantSnap has seen significant rapid growth. In its advertising documents, management stated that revenue in 2018 totaled $3.6 million, a 10-times increase over 2017. In its Form C filing, though, it shows something different. Last year, PlantSnap as a company generated net revenue of $2.17 million. In 2017, the figure was $191,668. The filings do specify that revenue figure as ‘net’. As such, it is possible that the difference is due to some cost that gets subtracted from gross revenue to arrive at net. It’s uncertain what that might be, but typical candidates include royalties or commissions. The net loss last year was $6.79 million, up from a loss of $2.16 million a year earlier. One significant cost item for the company was its sales and marketing expense. In 2018, the company spent $4.34 million on sales and marketing activities. A further $1.51 million was booked for interest expense. Management has now said that it estimates its ongoing burn rate will be about $125,000 per month. If this is true, it’s possible the company could be earnings positive moving forward.

This leads us to the darkest part of this opportunity. A sizable, fast-growing social network with additional offerings in the pipeline should be losing money. Probably a lot of it. That’s completely fine for its current stage. What is scary, though, is what you see when you dig into the business’s balance sheet. As of the end of its 2018 fiscal year, the company had total liabilities of $9.12 million. Assets, by comparison, were a paltry $515,694. The entire liability story is complex. The short version is that the company took on early cash from investors, offering in return a mix of royalties and high-interest debt. It is worth mentioning that this early investor refers to a related party under the names of DEJ FLP (Family Limited Partnership) and DEJ LLC.

Any unpaid royalties bore interest rates and interest rates on various debt securities were as high as 148% per annum. Over time, management consolidated these commitments. According to page 16 of the company’s Financial Statements and Independent Accountant Review Report, the latest consolidation was for $9.10 million. This occurred in October of 2019. This new debt bears an extremely high 16% annual interest rate and some other rather onerous terms.

In essence, the agreement stipulates that the lender can demand payment at any point in time. The debt also comes due in the event of a change of control and/or a dissolution or liquidation of the company. The loan is currently secured by all of the company’s assets, plus 750,000 shares owned by the CEO. This does not mean that anything nefarious will happen. In theory, though, it sounds like the lender could demand payment today and effectively take control of the company in its entirety if payment is not rendered. The current capital raise does not change this possibility. That is unless some undisclosed clause of the current agreement exists or unless an amendment is made to these terms. This creates a high-risk situation for prospective investors.

An Opaque Market

It’s difficult to estimate precisely what kind of market opportunity exists for PlantSnap. In its filings, management stated that this is a $340 billion market with 1.80 billion prospective users. Besides a reference to Facebook analytics the company derived the 1.80 billion figure from, no reference was given on these numbers. References to individual reports on the plant and garden market were provided. However, each of these were several hundred dollars in order to access.

What complicates the market analysis is the fact that simply looking for something like ‘people who love plants’ is overly broad. Anything else becomes rapidly too narrow or groups in other industries. As an example, one source looked at the market for both zoos and botanical gardens in the US in 2017. That year, combined revenues totaled $3.6 billion. Another source looked at data for 650 zoos and botanical gardens, as well as 710 nature parks. It estimated industry revenue in the US at $14 billion, but its figures also included 1,200 historical parks and 5,100 museums.

Another approach at analyzing the market is to triangulate some figures based on what data is available. For instance, 1-800-Flowers.com does not discuss market size, but in 2019 the company sold nearly $500 million worth of products through its Consumer Floral segment. Of these sales, 98.3% were e-commerce, with the company boasting 29 million e-commerce customers and seeing 13.2 million e-commerce orders. On the mass-market side of retail, another source, referencing the US Bureau of Economic Analysis, estimated the size of the nation’s floriculture market. For 2015, it is estimated that sales totaled $31.3 billion. Two other sources suggested a similarly-sized market. One gave a figure of $34.3 billion for the US flower industry and another pegged it at $35.2 billion.

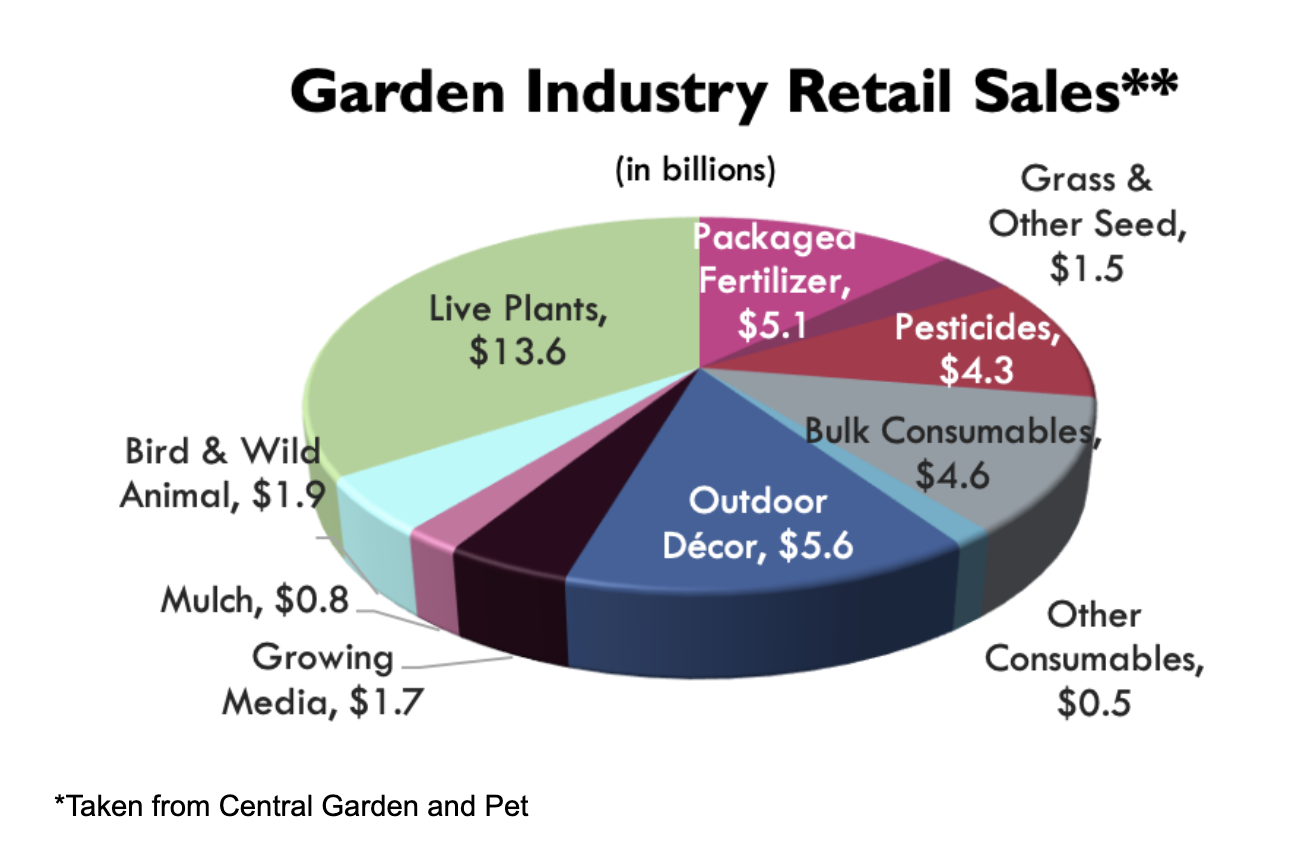

Perhaps the best data available comes from Central Garden and Pet. Last year, the company’s sales in the garden space were $874 million. This accounts for about 2.2% of the $39.6 billion US market the company said exists. About $13.6 billion in sales are classified as falling under the category of Live Plants. The rest centered around ancillary products like mulch, outdoor decor, consumables, and more. Growth seems to sit around 6% to 8% per annum. Unfortunately, no significant data can be found regarding the broader global industry, but the market as it stands today in the US is sizable. It’s not unreasonable to assume the global picture is many times larger.

Terms of the Deal

The deal PlantSnap is looking to close is fairly straightforward. Management is offering Series B Common Stock in the enterprise at a price of $35.86 per unit. The minimum investment required by a participant is $251.02 (7 shares), and shareholders in this deal will not have any voting rights. Management is looking for a minimum close of $9,969.08 and a maximum close of $534,995.34. As of this writing, the company has received commitments for $205,585 from 307 investors. The pre-money valuation is a rich $33.995 million. Given the growth rate the company has seen and the pipeline of apps it is working to launch, though, this may not be unreasonable.

An Eye on Managment

PlantSnap has an extensive team behind it, including a full development team and a CRM, but the two core members appear to be Eric Ralls and Ivan Iliev. Eric, PlantSnap’s Founder, CEO, President, Chairman, Treasurer, and Secretary, fashions himself a serial entrepreneur. His education experience is in psychology and international business. From 2002 through 2012, he was the Founder/CEO of RedOrbit. From 2014 to 2016 he was the Founder/CEO of GreenAtom, and since 2016 he has served as the Founder/CEO of Earth.com 2016 and of PlantSnap. Ivan currently serves as PlantSnap’s CTO. Prior to his time there, he worked at Eden Tech Labs, a boutique mobile app development company, where he served as its Founder and CEO. Before that, from 2009 to 2017, he was the COO of SINI Ltd., a construction company.

The Rating: Deal To Watch

It was challenging to not rate PlantSnap a “Top Deal”, which is King’s Crowd’s highest designation for ideas. The company’s tremendous growth rate, mass appeal, unique value proposition, market opportunity (even with how opaque the market is), and pipeline of other projects already in the works makes it incredibly attractive. This is the type of idea that, if executed appropriately, can be worth hundreds of millions of dollars or more. At the end of the day, though, we settled on rating PlantSnap a “Deal To Watch”. This is our second-highest ranking, placing it in the top 10% to 20% of companies analyzed.

The fact that PlantSnap generated significant net losses over the past two years have nothing to do with this decision. That’s to be expected in this situation. What isn’t, though, is the significant amount of debt on its books and the vampiric terms of said debt. Though there is no guarantee this will happen, the fact that the lender can effectively seize control of the company at any time is disturbing. It would be different if management had the financing to meet its obligation, but that is simply not the case. Equally disturbing are the high interest rates that related party has charged the company over time. This includes the 16% annual interest rate imposed today, when the business is already generating millions of dollars in sales.

Moving forward, PlantSnap very well could be a success, and in all probability it might go on to be worth several times what it is going for today. However, to ask investors to stake their capital on a business with such high debt that itself carries such onerous terms warrants a step back. This has turned the opportunity from being an all-star prospect to being a double-edged sword. The upside potential is there, but so too is the risk.