Title III of the JOBS Act was rolled out by the SEC on May 16, 2016, so last week, Regulation Crowdfunding turned three years old. Hooray! Candles! Cake! Happy Birthday! This blog post addresses some of the stats, some of the successes, and some of the challenges that still impede the faster adoption of unaccredited investor crowdfunding in the United States. While I touch on other platforms, I primarily focus on Wefunder — partly because I work for Wefunder. And partly because we’re the coolest.

Wefunder homepage

Wefunder homepage

Some Stats

Market Overview

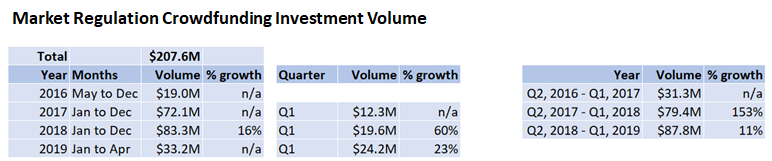

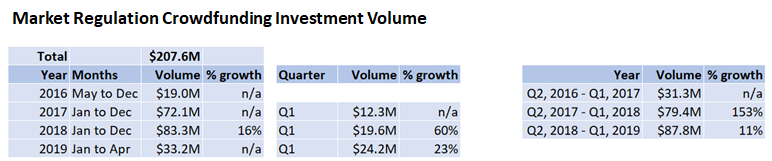

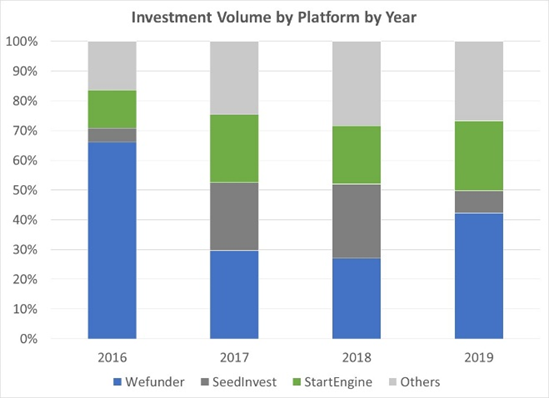

In April 2019, Regulation Crowdfunding (Reg CF) passed a milestone of $200M in cumulative investment volume. As the table below shows, through the end of April 2019, $207.6M had been funded.

From the first full year of data (Q2, 2016 to Q1, 2017) to the second full year of data, the market grew at 153%. From the second full year to the third, this growth rate slowed to 11%. Although Q1, 2019 was 23% up on Q1, 2018, and April 2019 was another very strong month (over $9M).

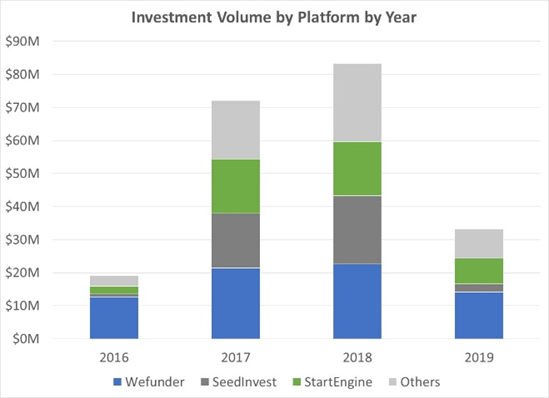

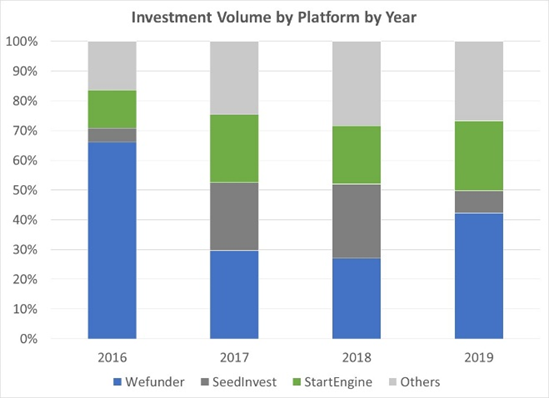

Since Reg CF launched, Wefunder has had a market share of about one third. Due mainly to a slow Q1, we did not see much growth from 2017 to 2018. But 2019 has started very well, with Q1 2019 up 352% on Q1 2018. Our market share has increased to 42% so far in 2019 — up from 27% in 2018 — driven mainly by strong Wefunder performance, and a drop in SeedInvest volume.

The leading six platforms through the end of April are as follows:

In late 2018, SeedInvest announced its acquisition by Circle, which may explain its decline in investment volume in 2019. Another interesting industry development over the last few months was the dissolution of the joint venture between Indiegogo and MicroVentures. Today, MicroVentures is going it alone, which might also explain their drop in market share so far in 2019.

Wefunder Portfolio Overview

Historically, SAFEs have been the most common type of security on Wefunder, accounting for 40% of investment volume (and a higher proportion of the number of companies launched). As would be expected, Priced Rounds have raised more capital on average, probably reflecting that companies raising through a Priced Round are typically further along than companies raising through a future equity contract (i.e. SAFE, Convertible Note).

Debt offerings (i.e. Revenue Share, Standard Loan) have reflected a relatively small part of Wefunder’s portfolio (only 11%). Hops and Grain (revenue share) and Boardwalk (a standard loan to open a Ben and Jerry’s franchise on Venice Beach) are notable exceptions.

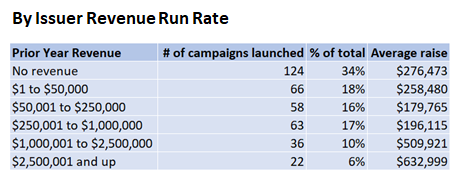

Perhaps surprisingly, over one third of Wefunder companies launched were pre-revenue. Many of these companies had lower raises, but this group includes healthcare companies still going through the FDA approval process — like Beta Bionics, who raised $1M.

Less surprisingly, companies with significant revenue run rates have raised more money on average. For the 22 companies that launched with revenue of over $2.5M, the average raise was $633K.

Investors and Investments

As of a few months ago, 37,672 people had made an investment on Wefunder. For users whose gender we know, 73% are men and 27% are women. While we would love this 27% number to increase over time, it is already higher than the corresponding percentage of conventional angel or venture capital investors who are women.

14% of Wefunder investors (whose age we know) are under the age of 30. 32% are between 30 and 40; 24% are between 40 and 50; and 29% are over the age of 50.

The mean Regulation Crowdfunding investment amount on Wefunder is around $1,000. But the median investment is just $250.

Source: Wefunder internal data

Source: Wefunder internal data

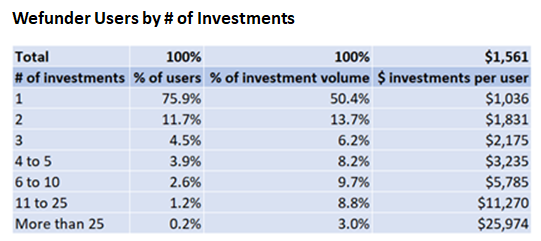

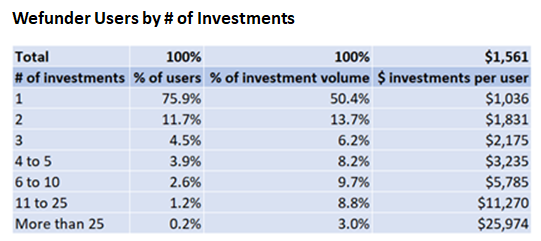

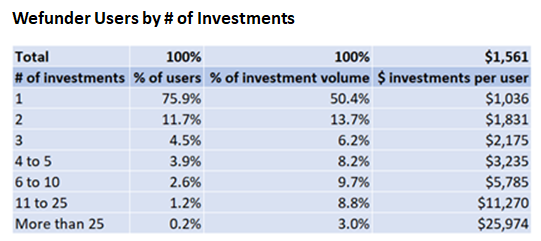

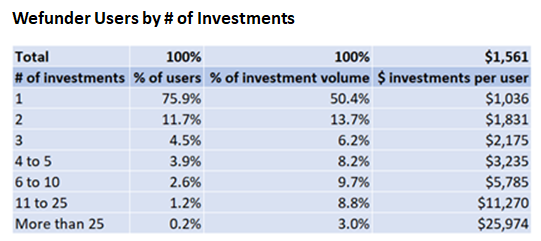

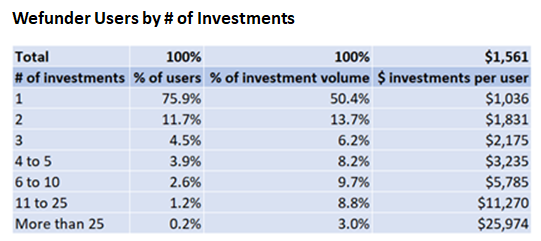

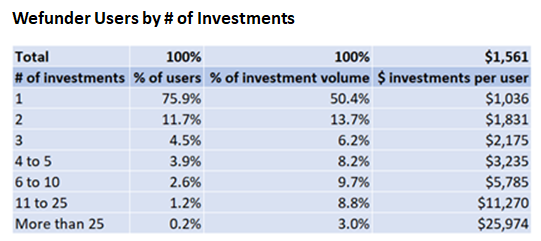

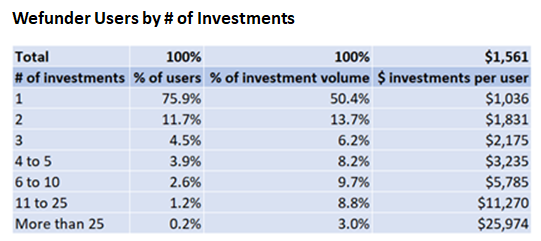

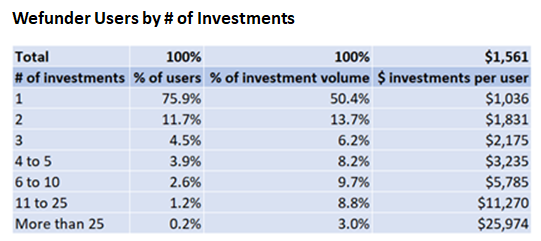

As can be seen from the table above, the majority (75.9%) of Wefunder investors have only made one investment. These investors account for around half of all investment volume. This is unsurprising, given many investors learn about Wefunder, and make their first investment on the platform, because they are attracted by a particular company that they have an existing relationship with (e.g. a brewery in their home town, or a tech founder they already know). Initially, they are “investing in Modern Times”, as opposed to “investing through Wefunder”, or “investing in early stage startups”. Over time, we expect the number of investors making repeat investments to grow, as the liquidity of companies on the platform grows (e.g. companies in an investor’s city, companies in a sector they work in, etc.).

Some Successes

Success Stories

On the Wefunder team, we’re inspired and galvanized by the stories of the companies in our portfolio, and their successes on our platform. Some examples include:

Meow Wolf — An immersive art experience in Santa Fe, NM, Meow Wolf raised $1,322K from 621 Wefunder investors. Companies with a large audience of fans that love them are the absolute sweet spot for Wefunder, and when given the chance to invest in Meow Wolf, their fans responded rapidly — their entire million-dollar raise was wrapped up in just a few days. Meow Wolf has since gone on to raise $17.5M in follow-on financing from impact investors, as they look to expand to other cities.

Beta Bionics — Wefunder is a Public Benefit Corporation and a B Corp proud to support startups making a positive social impact. Developing a bionic pancreas to tackle diabetes, Beta Bionics raised $1,000K from 718 investors, many of whom had had family members affected by diabetes. To-date, Beta Bionics looks like a great financial investment too, having just closed $120M from Novo Nordisk and other investors.

Minds — Minds is a decentralized social network, which raised $1,036K from 1,541 investors in June 2017. For a company like Minds committed to democracy and decentralization, Wefunder represented a beautifully complementary approach to raising capital. Minds raised $6M in follow-on financing from Medici Ventures in late 2018.

Legion M — Having run a combination of Regulation Crowdfunding, Regulation D and Regulation A+ campaigns, Legion M has raised the most of any Regulation Crowdfunding company on Wefunder. On the Wefunder team, we believe that one of the great advantages of running an equity crowdfunding campaign is that a company can recruit an army of more loyal customers and enthusiastic brand ambassadors — and Legion M, a movie company, have gone “all in” on that. Legion M now have 16,000 investors through the Wefunder platform, who they actively manage, engage and leverage. Legion M’s vision, now coming to life, is that for every movie they launch, they now have a hoard of 16,000 promoters. It’s powerful. And it’s working.

Modern Times — One of the top 50 craft breweries in the US, Modern Times recently raised $1,194K from 1,930 investors in just one week. With revenue of $19M, Modern Times was the largest company ever launched on Wefunder, proving the model can be valuable for larger firms, as well as early stage startups. The Modern Times team’s vision of building a company owned by employees and customers is what Wefunder is all about.

Chattanooga FC — Aiming to be the Green Bay Packers of American soccer, Chattanooga FC will soon be concluding it’s Wefunder raise (they have currently raised $729K from 2,656 investors). Their expectation is that these investors will attend more home games, buy more merchandise, and become more avid fans. For many citizens of Chattanooga, they are now shareholders in their town’s leading sports franchise. As well as an opportunity to make money if Chattanooga FC is financially successful, there’s an ownership there. There’s a pride.

MySwimPro — MySwimPro is a swimming coaching app that has won prestigious “App of the Year” awards from Apple. In September 2017, MySwimPro raised $131K from 137 investors. Their CEO, Fares Ksebati, did a tremendous job regularly updating his investors with compelling content, and his investors then doubled down when he raised $468K from 208 investors through Wefunder in April of this year. Fares notes that several significant strategic partnerships were struck as a result of these partners investing in MySwimPro, and receiving these updates. This is a big part of our vision on the Wefunder team — that the hundreds of investors that a company recruits through our platform can support that company in a myriad of ways — through business development deals like these, by helping to source engineers for an open position, providing product feedback, making valuable connections, or (most simply) just spending more money with the company they are now invested in.

Expanding Access

From a more quantitative perspective, hundreds of founders have been able to raise over $200 million in capital through the Regulation Crowdfunding exemption rolled out in May 2016. I typically cite three ways in which Reg CF enables founders to tap into additional pools of capital: Firstly (and most obviously), founders can publicly promote their offering, and raise money from unaccredited investors in their network (professional connections, customers, friends and family, etc.), as well as accredited investors. Secondly, founders can tap into Wefunder’s growing network of investors, who typically account for around 50% of the amount raised on an average campaign. That means that, if a founder can raise $500K from their own network, on average they will raise $500K from Wefunder’s investor base, for a combined raise of $1M — and we expect the percentage coming from Wefunder’s existing investor base to grow over time, as our investor base increases in size. Thirdly, by offering investors a chance to come in at a lower check size (e.g. $5,000, rather than $50,000), founders can turn investors’ “Nos” into “Yeses”.

And on the investor side, Reg CF has given tens of thousands of individual Americans (and people from around the world) a chance to invest in early-stage private companies. Jason Calacanis invested $25,000 in Uber, and made $125M in its recent IPO. Why should these sort of explosive investment opportunities be restricted to rich people? Of course, unless these investors can generate positive financial returns, the economic advantages for unaccredited investors who participate in Regulation Crowdfunding will be missing. But even where investors lose their money (which will be the vast majority of cases, based on traditional angel and venture capital investing), we believe that good things will derive from millions of Americans engaging directly with entrepreneurs and entrepreneurship, and owning a piece of small, fast-growing companies, as well as large, publicly listed ones.

As cited above, the growth rate of the Reg CF market has not been exponential, but if (when) it accelerates with regulatory reform and increasing awareness of the model, it will start to make a more and more meaningful dent in early stage investment over the coming years.

“Equity” Crowdfunding

Equity crowdfunding can refer to the fact that people are investing in companies’ equity, rather than getting perks (i.e. Kickstarter, Indiegogo, etc.). But the double entendre is that it can also refer to crowdfunding delivering more equitable outcomes than conventional financing systems.

The previous section touched on questions like “why should a large company like Starbucks be able to raise money from middle class Americans, but a local, independent coffee shop be prevented from doing so?” Or “why should a millionaire be able to invest in the next Facebook, but a schoolteacher not be allowed to?” But equitable outcomes can also refer to crowdfunding’s potential to level the playing field for certain founders that have been historically excluded.

For example, last year, while 79% of venture capital went to male-only founder teams, only 2% went to female-only founder teams. Less than 1% went to African-American founders, and a similar amount went to Latinx founders. And 77% went to three states: California, New York and Massachusetts. While crowdfunding won’t immediately deliver a totally levelling field along those three dimensions (gender, ethnicity and geography), it can help to bridge the gap. For example, since May 2016, 50% of Wefunder investment volume has gone to those same three states (CA, NY, MA), compared to 77% of conventional capital (and Wefunder is headquartered in California).

Vanessa Braxton, the CEO of Cleveland Whiskey, who raised $1.5M over two successive raises, are a great example of a fast-growing company in the Mid-West bringing in investment capital from outside of Ohio to fuel their growth.

“Social” Capital

Another play on words we can have fun with is “social” capital. Typically referring to the non-monetary value that investors can bring to a company (e.g. connections, advice, etc.), with respect to crowdfunding, “social” can refer to two more ideas: Firstly, that the capital is being sourced more democratically (e.g. social media vs. conventional, centralized media). And secondly, that investors may have more nuanced, social-impact-oriented motivations for investing. When a VC invests in a startup, they are usually pretty primarily driven by a desire to make a lot of money — for their LPs, and for themselves through their 20% carried interest. But when a citizen of Cleveland invests in Cleveland Whiskey, they might make that decision in part based on the fact that their son works for the company, they love the whiskey, or they know Tom Lix, the CEO. When I personally invested in Chattanooga FC, I didn’t read the financial statements. I just thought it was really cool to become a part owner in a soccer team for $125. I’m buying a shirt, and looking forward to watching my first live game soon. I’ll be cheering extra loud.

Not all Reg CF investors will be motivated by social impact. Many will just want to maximize their financial returns. But that’s the beauty of democracy — it can allow for infinite preferences and approaches. And this kaleidoscope of investor motivations can enable companies to raise capital, where otherwise they may not have been able to. Imagine a company working on a cancer drug in the early stages of the FDA approval process. If it works, it has the potential to radically improve outcomes for cancer patients. But at this early stage, there’s only a 5% chance it will work. And financially-motivated investors need a 7% chance to make the financial return they are looking for. So they don’t invest the $1M that the company needs. But it seems like a very good thing for America to make that 1 in 20 bet, instead of investing in another meal delivery company that offers an 8% financial return to investors, and so currently gets the $1M capital infusion. Reg CF investors who have had family members afflicted by cancer may make that bet, as they did with Beta Bionics (diabetes), Venomyx (antivenom for snakebites). Growing numbers of impact investors are already starting to consider the social returns of their investments, as well as the financial returns. But Regulation Crowdfunding can accelerate and democratize that trend.

Some Challenges

So far so good, right? Everything rose-tinted in Reg CF World? Well not quite. There are definitely some significant challenges to the growth of Regulation Crowdfunding as a model, as alluded to above. I address five of the principal ones below:

Long Cap Tables

When a startup raises capital through Regulation D from a syndicate of accredited investors (e.g. on AngelList), those investors can be rolled up into one Special Purpose Vehicle (SPV), and one line on the company’s cap table. Unfortunately, as the regulations currently stand, with Regulation Crowdfunding these investors generally need to be listed separately on the company’s cap table.

At Wefunder, we try to mitigate what would otherwise be the most detrimental effects of a long cap table — for example, most of our founders transfer voting rights from their Wefunder investors to a designated proxy (e.g. the founder themselves), and typically Wefunder investors do not have pro rata rights to maintain their ownership percentage in future financing rounds.

All the Wefunder investors have the same terms (same valuation, liquidity preferences, discount rates, maturity dates on the convertible note, etc.), and so while the cap table may be long, it is relatively simple. And concerns around “the time it takes to manage investors” are usually unfounded — an investor who puts in $50K will probably be “up in a founder’s grill” to a significant extent. But if a Wefunder investor puts in just $100, they will probably be a little more relaxed. We encourage our founders to regularly update their Wefunder investors — mostly because investors who are kept engaged can be more valuable assets for the company. But the only legal requirement of Reg CF is to provide an annual report to investors.

Wefunder’s system spits out all the contact info, # of shares and relevant info for a company’s investors, and it’s pretty cheap and easy to upload and manage this through a cap table management platform like Kore ConX or CapTable.io.

But nonetheless, while the perception of a cap table with 300 investors (the average number for a Wefunder campaign) may be significantly worse than the reality, this is still a deterrent to many founders. Especially when they hear from potential follow-on venture capital investors that “oh you must have a clean cap table. That is very important.”

The JOBS Act 3.0, currently in the bowels of Washington DC, would fix this (among other things). It has already passed the House 406–4 (i.e. remarkably bi-partisan support!), and we hope it will pass the Senate soon (although apparently, Donald Trump and Chuck Schumer don’t like each other very much). When this passes, we expect the growth rate of Regulation Crowdfunding to significantly accelerate. But until then, long cap tables will remain the biggest reason why founders eschew Reg CF as a mechanism for raising capital.

Signaling Effect?

Another concern I have heard from the best founders about Reg CF is that it is a “bad signaling effect”. The thinking is: “If I raise money through equity crowdfunding, later investors will think that I couldn’t raise money from “real” investors, and had to go the crowdfunding route as a last resort”.

Personally, I think there is an easy answer for a confident founder here, along the following lines: “Oh no. I was not short of offers. I just wanted my earliest investors to be my customers and community. Both because I think thought that was a good thing to do in itself (i.e. giving my earliest supporters a chance to participate in my company’s growth and success). But also because I thought it would do good things for my company. And it has. Look — these 812 investors invited 3,415 new users to subscribe to our platform over the last 12 months, and 3 of our 9 employees were directly sourced through referrals from our Wefunder investor base”.

But again, as with long cap tables, perception is reality. And until there are more and more success stories (like Modern Times) to enhance the credibility of equity crowdfunding, it will retain some level of negative stigma, especially in the eyes of more stodgy investors.

Testing the Waters

One of the biggest challenges with launching an equity crowdfunding campaign is this: You don’t know if you’re going to be successful, based on the terms of the offering that you go live with, right before you press the Launch Button. Maybe you opt for a $5M valuation, but that only gets you $300K of the $600K you were looking for, over the course of a 4 month campaign. If you had gone with a $4M valuation, you would have raised $600K in one month. But it’s tough to know that ahead of time.

There are ways that you can mitigate this risk — the best way, which we encourage all Wefunder founders to do, is to validate your terms with a few accredited investors, who you have pre-existing relationships with, before going live with your Wefunder campaign. Can you soft circle an investment from that investor for $25K on day one of the campaign, at a valuation of $5M? Or would it need to be $4M for them to invest? With a few of these data points, you can start to establish whether you are in the right ballpark.

The United Kingdom launched equity crowdfunding a few years before Reg CF was rolled out in the United States, and the market has grown a lot more significantly there. One of the biggest reasons for this is that the UK regulations allow for “testing the waters”, which solves the problem articulated above. With testing the waters, a company can start to publicly communicate about its interest in raising equity capital from the crowd, before filing a Form C and officially launching their campaign. This can build their confidence that they will be successful. Or equally valuably — show them when equity crowdfunding is not going to be a good fit for them.

The Wisdom of the Experts

At Wefunder, we believe there is wisdom in the crowd. When I led the Kiva U.S. team crowdfunding microlenders to small businesses throughout the United States, there was a strong correlation between the number of lenders to a particular business and the repayment rate of that business. And at Wefunder, we regularly see that the offerings we are most confident in fund very quickly on our platform. While offerings that seem more borderline have a harder time recruiting investors.

On first glance, it’s easy to be skeptical that an “unsophisticated” investor would ever be able to make sensible investment decisions, compared to an extremely-dark-jeaned venture capitalist who has been doing this for years and does it full time, for their job. (I’m not talking about deal flow here, just “making investment decisions”). But a typical pitch meeting might last for less than an hour. Whereas the “unsophisticated” investor might have known that founder for 25 years. Or the Latina founder who grafted through community college might not match the stereotype that the rich, white men at the VC fund are looking for. Many VCs have passed on future unicorns for sure. And many “accredited” investors piled sheepishly into Theranos.

But all that being said, at Wefunder we do see a need for the “wisdom of the experts” to complement the “wisdom of the crowd”. If everyone is only putting in $100, then who’s going to take the time to really dig through the company’s financials in detail, or benchmark their valuation multiple against industry comps. Wefunder plays this role to an extent (we reject the vast majority of applications that we receive). But if we’re as restrictive as conventional investors, then all of the benefits of equity crowdfunding listed above are eliminated, and we’re just another gatekeeper like every other VC firm.

We are continuously iterating as we search for better and better ways to capture the wisdom of experts, but doing this effectively remains a vexing challenge for Wefunder, and the industry as a whole.

The Limits of “Equity”

One of the principal reasons I work at Wefunder is that I am frustrated by the very low percentage of conventional capital (including bank loans, as well as angel or venture capital) currently flowing to entrepreneurs of color. It seems to reinforce a vicious cycle where entrepreneurs of color struggle to access capital. Which means they have a harder time building fast-growing businesses. Which means it’s harder for them to build wealth through these businesses. Which means they have less wealth to fund the creation of future businesses. But they also struggle to access external capital, and we’re back to where we started.

One of my hopes for crowdfunding (both through the Kiva U.S. program I ran for the last seven years, and for Wefunder) is that it can deliver more equitable outcomes for founders — because investors can immediately look like the founders they are investing in.

But while median household wealth for African-American households is just 10% that of median household wealth for white households, there is less existing wealth in the African-American community (on a per capita basis) for that African-American founder to tap into through equity crowdfunding. As noted above, I still expect equity crowdfunding to deliver more equitable (level-playing-field) outcomes than conventional financing structures, but these deep, existing wealth disparities mean it’s not a silver bullet here.

Some Aspirations

Three years into Regulation Crowdfunding’s journey, there are some significant challenges facing its more widespread and rapid adoption. But it’s very early days. And there are already some regulatory challenges moving forward (the Jobs Act 3.0) that would completely eliminate at least two of these challenges (long cap tables and testing the waters), and ameliorate others.

One source of optimism is the equity crowdfunding scene in the UK. CrowdCube is the largest platform in the UK, and they are roughly 10x bigger than Wefunder by investment volume. But the UK VC market is roughly 10x smaller than the US VC market. So if Wefunder could get to a similar market share of UK venture capital, as CrowdCube has of UK venture capital, we would be 100x bigger than we are today. And we’re currently on track for $40M of Reg CF investment volume in 2019.

Entrepreneurship has been on the decline in America for decades. Turning that around will be very very hard. At Wefunder, we believe that equity crowdfunding can be one component of the solution. The challenges make us stronger.