Top Deal: Continued Success of the On-Demand, Tech-Driven Pharmacy

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

NowRX has been selected as a “Top Deal” by KingsCrowd. Today, we are reiterating this Top Deal rating, reserved for the top 10% of all deals across the market. If you have questions regarding our deal diligence and selection methodology please reach out to hello@kingscrowd.com.

Since We Last Saw NowRx...

NowRx, a technology-driven, on-demand pharmacy, was rated a Top Deal by Kingscrowd in May of 2018. The team is now raising its Series B round as a Regulation A offer on SeedInvest with the ultimate goal of developing AI-powered robotic technology for free, same-day delivery of both prescription and over-the-counter (OTC) medications. In doing so, the team aims to eliminate the need for pharmacies altogether, heavily disrupting the $313B pharmaceutical market.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

NowRx Financials Update

In March of 2018, NowRx closed its seed round at $1,345,000 on convertible note with a $10M valuation cap. Its series A closed in August of the same year at $6,796,700 in preferred equity with a $20M pre-money valuation. The current campaign offers preferred equity at a pre-money valuation of $65M.

NowRx revenues for 2018 were $4.7M, nearly a 90% increase from the previous year. Gross profit for 2018 was $634K, compared to $334K in 2017. With an increase in revenue from 2017 to 2018 also came an increase in total operating expenses, which stood at $1.3M and $3.5M, respectively.

As of July 2019, revenue stands at $7.2M. To date, NowRx has filled over 100k prescriptions. Though the valuation has gone up significantly, this significant increase in revenue and proven traction derisks the investment.

Why We (Continue To) Like It

- Ripe Market For Acquisition: When we last covered NowRx, it was rumored that PillPack was nearing acquisition. The company did in fact get acquired by Amazon in June of 2018 for $1B.

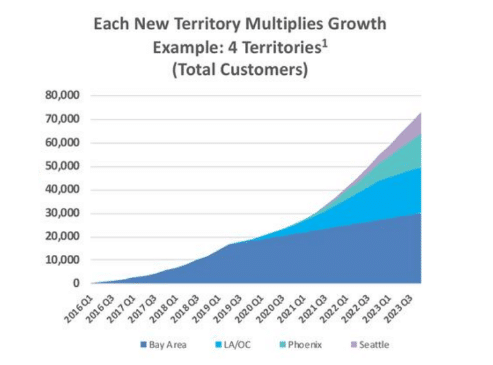

- Growth Plans: As of now, NowRx serves only the Bay area, making geographic expansion a natural next step in scaling. By 2023, NowRx plans to expand to 20 territories. This expansion will begin in the Los Angeles and Orange County areas and later move up and down the west coast with the ultimate goal of having 5-10 locations per metropolitan area. The team anticipates a 3x growth rate in its already established Bay Area base with the addition of these new locations due to the ramping up of customer marketing and sales efforts.

Since its last raise, NowRx has significantly sped up growth in the Bay Area where it was originally established. With each funding round, customer acquisition has increased. In addition, the team has opened two licensed micro-fulfilment centers in the Bay Area. A third facility in Orange County has also been leased. Retention rates are also high, with 86% of users claiming that it is “extremely likely” that they will use NowRx again. High satisfaction rate ground proof-of-concept before continuing geographic expansion.

- Data Aggregation: As with any machine-learning algorithm, the more data the better. NowRx has already acquired a substantial amount of customer data to better its systems. Efficiency and accuracy of these algorithms can only improve with more data. Not to mention, a large database could prove to be quite valuable in the event of a future acquisition, upping price point and overall value of the company.

The Rating: Top Deal

NowRx remains a Top Deal. Since we first rated this deal, the company continues to grow and significantly increase both revenues and margins.

Despite the fact that the valuation has gone up significantly, the continued increase in revenue, gross profit, and general traction derisk a potential investment. In addition, the team has clear plans to scale geographically, at which point it can be safely assumed that general profitability will follow en suite.

This is not to mention the strong team and impressive investor backing. CEO and founder Cary Brees, a seasoned entrepreneur that helped found a $50M VC fund, has stayed with the company. As has Co-Founder and CTO Sumeet Sheokand, who boasts plenty of prior management experience. In addition, since we last covered NowRx, Ulu Ventures, an early-stage, IT-focused, fund based in SF has come on board.

Finally, acquisition in the space is definitely possible. Since we last covered NowRx, PillPack was acquired by Amazon for $1B. Continuing to accumulate a customer database for the training of algorithms makes NowRx even more valuable from a data and software standpoint and could very well be bought up solely for one or both of the latter mentioned features of the service.

This is a company that is raising capital and executing on that capital in an efficient and focused manner. These types of results driven by clear market demand and experienced management execution make this a continued exciting investment opportunity.

About: Olivia Strobl

Olivia comes to KingsCrowd with a background in venture capital and technology. She spent time at Glasswing Ventures, an AI-focused venture fund in Boston, before joining the KingsCrowd team. There she helped develop machine learning algorithms for the opportunity qualification of preseed and seed-stage startup companies. Prior to her time at Glasswing, Olivia worked in a lab studying the neural correlates of attention. She holds a degree in Neuroscience from Wellesley College.