Underweight Deal: High Stakes Preventative Care

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

The Life Imaging team has been selected as an “Underweighted Deal” by KingsCrowd. This distinction is reserved for deals not selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

Heart disease is a significant affliction that causes hundreds of thousands of deaths in the US every year. Cancer is as well. Both ailments combined account for a large number of deaths that occur in this country annually, but the cost is not just in lives, it’s in dollars as well. Part of the issue is that most Americans do not recognize nor take seriously the earliest symptoms of these diseases. Add to that a history in the US of not taking preventative care options seriously, and it’s likely that without some major technological change, suffering and costs will grow over time. Life Imaging’s goal is to tackle these concerns. They hope to achieve this by providing customers with cost-effective preventative care that can help to identify these medical issues long before they become dangerous.

Problem

Heart disease and cancer are serious diseases that plague the US. According to the CDC (Centers for Disease Control), in 2018 610,000 individuals died in the US as a result of heart disease alone. The most popular type of heart disease was coronary, resulting in the deaths of 370,000 individuals last year. Also that same year, according to the National Cancer Institute, 1.735 million new cases of cancer were diagnosed, resulting in 609,640 deaths. Cancer is so prevalent that a full 38.4% of men and women, combined, will be diagnosed with some form of it during their lives. In some cases, current technology limits positive outcomes. In other cases, the issue worsens to the point of no return because early symptoms are ignored. It is this second case, where an early diagnosis can mean the difference between life and death, that Life Imaging wants to tackle.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Solution

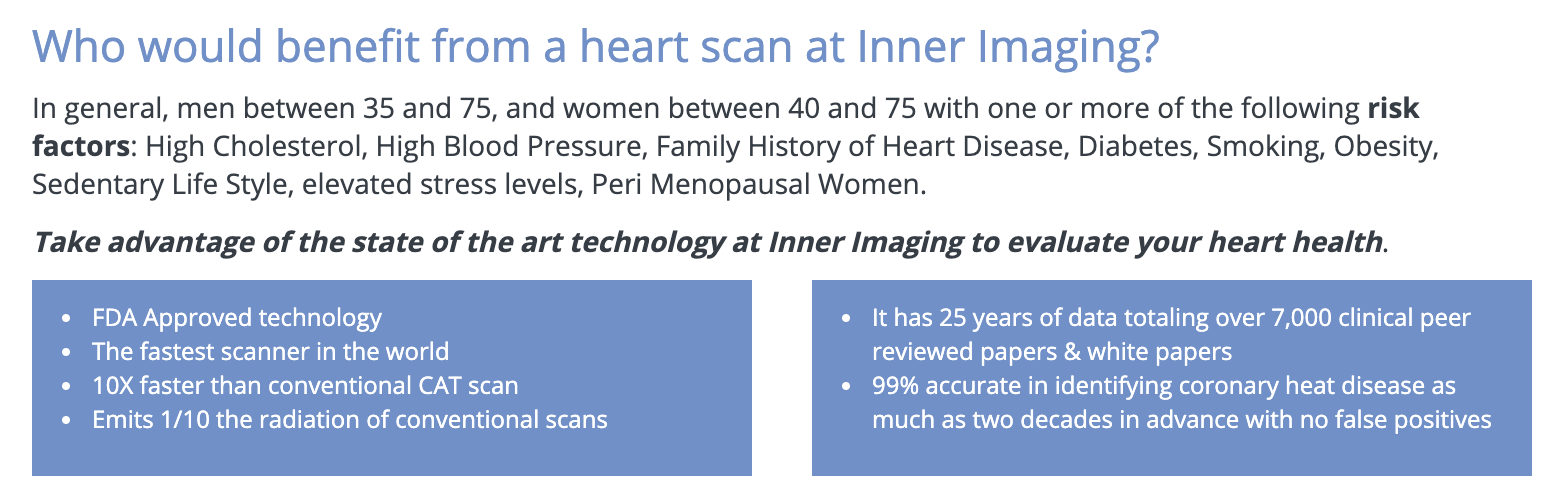

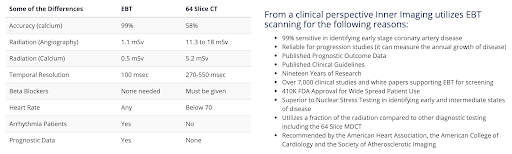

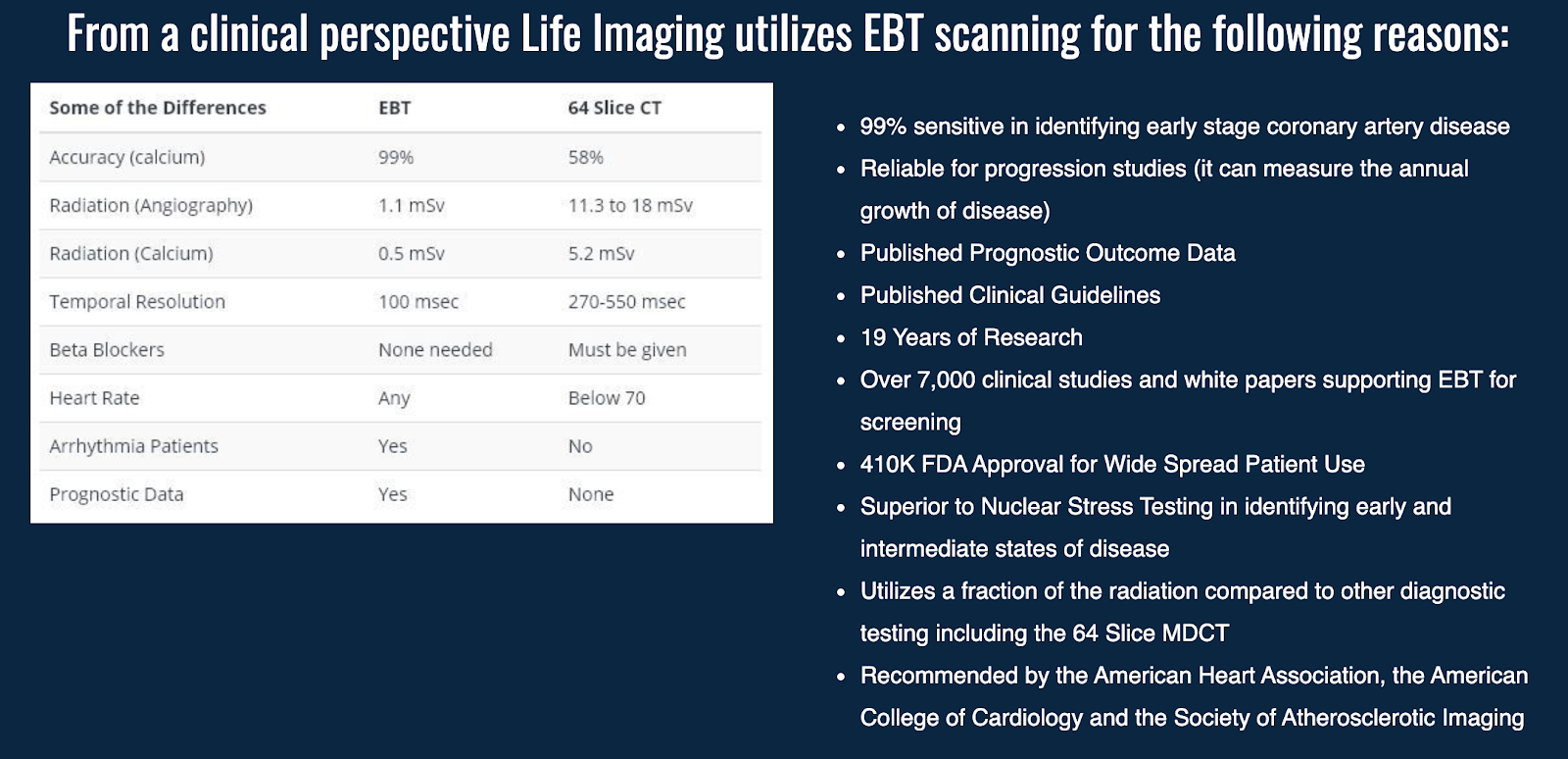

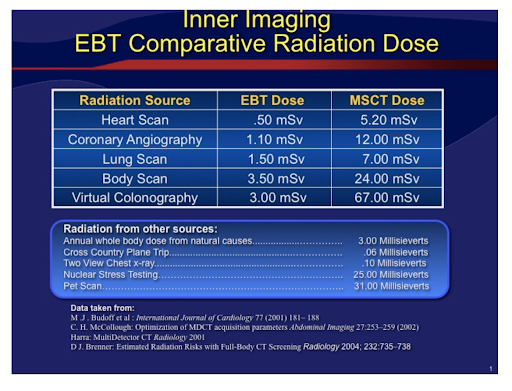

Life Imaging operates a simple business model. The company wants to open and operate clinics. At these locations, it will employ its FDA-approved EBT (electron-beam tomography) scanner. Management’s goal is to use this technology to catch some of the earliest symptoms of heart disease and various cancers. Customers will come in, pay a fee, and receive a full-body scan from the firm’s device. This device operates as an X-ray CT scan would, producing images, each one representing a slice of the body, rapidly. The objective is to then look at the images to see if and where calcium has built up throughout the patient’s arteries. The technology, ideally, should work with cancer as well. It’s also worth mentioning that this isn’t just any EBT scanner. Management touts that their technology is capable of performing the fastest and most accurate low-dose EBT scan on the market. In fact, the device exposes its clients to only 10% of the radiation of a normal CT scanner.

According to management, a separate company was set up and, over a four-month period, it ran a paid pilot. This pilot treated more than 120 patients and brought in revenue of $532,000. The gross profit on this pilot totaled $195,000, for a gross profit margin of 36.7%. This issue alone brings us to the first complication for Life Imaging. Even though the pilot program was not under the Life Imaging name, the $499 scanning cost, spread across 120 patients, does not add up. It only comes out to around $60,000. When pressed in the Updates section of its crowd raise page, management provided some much-needed clarity. They stated that the $532,000 figure refers to multi-year programs that clients signed up and paid for. This brings us to an issue involving accounting.

Technically, an entry for revenue coming from future periods, but paid today, should not show up as revenue. Instead, the company should book a liability on its books called Deferred Revenue. When the service is delivered, the liability should be reduced and only then should revenue be recognized. This stipulation also makes it impossible to say what gross profit would be for future periods. Costs associated with the procedures can only be realized at the time the revenue ends up being recognized. These are minor issues. Management wouldn’t be wrong to state that they expect those to be the results of the pilot when revenue is recognized in the future. In short, this point is an important technicality that management has wrong, but it’s not the end of the world.

Unfortunately, there are far bigger concerns to deal with. For starters, let’s review Life Imaging’s business as it has been set up. What investors are buying into is not the company that conducted the pilot. Instead, they are buying into a firm with a history of zero revenue, only $100 in assets, and a stockholder’s deficit of $5,596 as of July 31st of this year. If management raises the maximum $1.07 million it is seeking from its crowd raise, it intends to use 32% of the proceeds toward working capital. In its Form C filing, management specified this as being cash that will be spent buying the EBT scanner. In short, investors are not buying into a company with any special proprietary technology or any bona fide operating history. They are buying into an idea that consists of buying the scanner from another party and using it to service clients in Florida. Imagine a crowd raise centered on raising proceeds for a start-up baker to buy his kitchen supplies so he can begin baking. That’s the same kind of situation investors are being asked to invest in.

Inner Imaging:

Life Imaging:

Inner Imaging:

Life Imaging:

Inner Imaging:

Life Imaging:

This is not the worst of the picture though. The worst is that Life Imaging is playing fast and loose when it comes to content on its website. In short, the company has copied a lot of information verbatim from a competitor in New York, Inner Imaging. In the images interspersed above and below, you can see some of the comparisons. Perhaps the most unscrupulous example can be seen in the image below. On the left side of the page, you can see Inner Imaging’s comparative radiation dose for its technology versus an MSCT dose. On the right, you can see the same image from Life Imaging’s website, with the words Inner Imaging conveniently edited out.

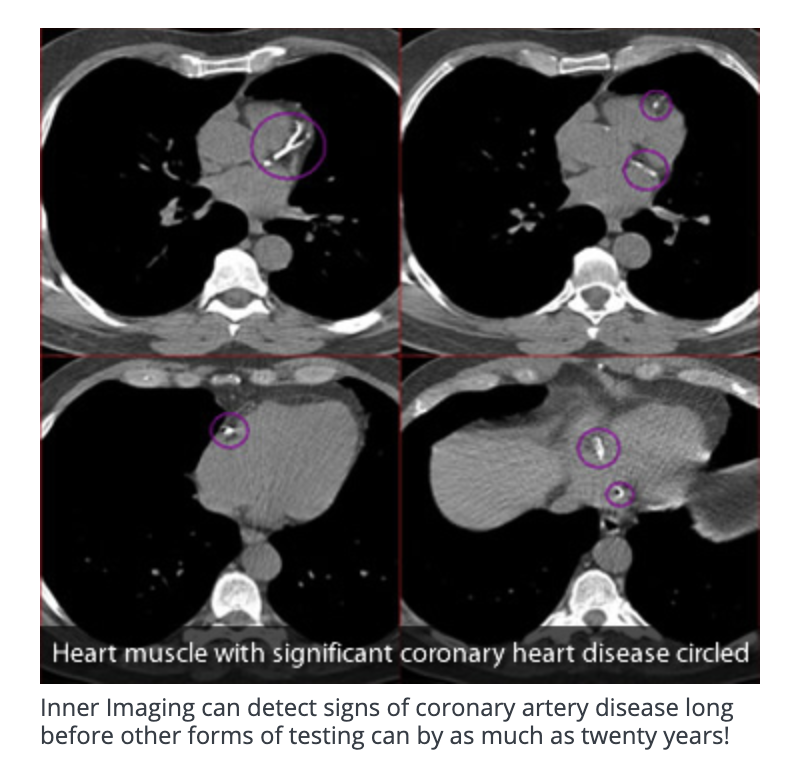

In the next image, shown below, you can see the same side-by-side comparison for a scan of a patient’s heart. Significant coronary heart disease is circled in each of these identical photos. On its own website, Life Imaging states that “Life Imaging can detect signs of coronary artery disease long before other forms of testing can, by as much as twenty years!”. This is verbatim what Inner Imaging says on its site. What’s more, is that it’s simply wrong. Life Imaging cannot detect anything because it does not currently own an EBT scanner. The efficacy of the EBT scan notwithstanding, only Inner Imaging can make this claim.

To ensure we had our story straight, we called Inner Imaging. We inquired as to whether they knew of Life Imaging and knew of the websites’ similarities. The individual we spoke with indicated that he did not know of the company. He did acknowledge that he had spoken with an individual from Florida who was interested in following the same path, but that was all. This makes it unlikely (practically impossible) for Inner Imaging to be owned by the friend and business partner Life Imaging’s business model is emulating. The same can be said of the separate company the pilot was done under. We also looked at other sources to see if a link/business relationship could be established between Life Imaging and Inner Imaging. There was no concrete evidence to suggest the two are in any other way affiliated with one another.

The Market

The market opportunity Life Imaging wishes to play in is significant. This is especially true if the technology the business intends to employ works like they claim it does. After all, the costs associated with heart disease and cancer are enormous. In addition, finding a way to reduce mortality would be handsomely rewarded. As an example, we need only look to the CDC Foundation for comment. In 2015, the healthcare costs and lost productivity associated with heart disease totaled $320 billion. By 2030, the organization expects direct healthcare costs associated with the disease to rise to $818 billion. Lost productivity will total at least $275 billion annually on top of that. The costs associated with cancer are also extraordinarily high. The National Cancer Institute estimates that the annual costs associated with cancer stand at $147.3 billion (as of 2017).

The idea of identifying an issue years, or even decades, before a problem arises is appealing. It’s an excellent way to create value. The problem, though, is that the academic and medical evidence surrounding EBT scanning technology is far from settled. On one hand, firms in this space claim that their preventative nature is worth the costs to clients in question. The FDA, as of 2017 at least, maintained that this is not the case. According to their review of the data, there is no evidence that full-body EBT scans like the ones proposed by Life Imaging and Inner Imaging are of benefit to people who are currently asymptomatic. In fact, continued use of the technology will expose users to radiation over time. This might be enough that it could increase their chances of actually getting cancer in the long run. Because of this, the FDA has even tightened regulations on the manufacturers of whole-body scanners. These providers are prohibited from advertising the technology to those who are not currently experiencing symptoms associated with heart disease, cancer, and more.

Inner Imaging:

Life Imaging:

Another issue here can be seen in the images above. Both Life Imaging and Inner Imaging have made the claim that the American Heart Association (among other organizations) supports the EBT scanner that the former will use and that the latter purports to use. While it is possible that the FDA’s data, which is from 2017, is out of date, we could not find any evidence supporting anything to the contrary. In fact, the FDA even stated that “Medical professional societies have not endorsed whole-body CT scanning for individuals without symptoms”. This absence of evidence is also why health insurance companies do not typically cover the costs of these treatments. Moda Health, for instance, cited insufficient evidence in its decision to not cover these scans for its clients.

Terms of the Deal

The transaction sought by Life Imaging is relatively straightforward. According to the filing documents from the firm, it is looking to raise at least $10,000, but its target is currently $1.07 million. The firm is selling Common Stock to investors at a price of $2 per share, with a minimum investment required of $200 per investor. The business has decided on a pre-money valuation of $3 million. This implies that ownership from its crowd funders will range between 0.3% (assuming a $10,000 raise only) and 26.3%. As of this writing, $33,334 has been committed to the firm.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Management

Life Imaging as it stands today is centered around one individual: James T. Graham. Graham operates as the company’s Founder, President, CEO, Secretary, and COO. He has spent the last 25 years as a serial entrepreneur. An unnamed company he built from 2004 to 2009 allegedly did almost $40 million in revenue and had over 100 employees. In its final year operating before he sold it to a private equity firm for $3 million, the business generated $18 million in gross revenue. After semi-retiring for a period, he experimented in some other industries. At one point, a personal tragedy struck his family. This, combined with a positive experience with holistic medicine propelled him into this space today.

The Rating: Underweight

Conceptually, the mission that Life Imaging is working on is laudable. The company wants to help the sick and potentially sick as early as possible. The fact that the focus is on a large section of society where significant costs are incurred is all the better. Any sort of progress made by management can create significant upside for the company and its shareholders in the process. However, having weight the evidence, this merits of this deal stop there.

At a minimum, the endeavor Life Imaging is working on is full of issues. These range from the tiny but forgivable statements regarding the pilot’s results, to the blatant copying of Inner Imaging’s website. The fact that management does not even really have a company is all the more problematic. This is because for the maximum 26.3% investors are receiving from this deal, they alone could go together and open a company from scratch. This business would have all the same assets and liabilities while owning 100% of it. In short, management is wanting cash for a startup when they will bring nothing but the day-to-day operations to it. This comes at the hefty price tag to investors of a majority of the business. Add to all of this the uncertainties over the efficacy of the EBT scanning, and the risks in this opportunity appear significant.

About: Daniel Jones

Daniel Jones is a graduate of Case Western University with a degree in Economics. He has spent several years as an equity analyst writer for The Motley Fool where he focuses primarily on the Consumer Goods sector but also likes to dive in on interesting topics involving energy, industrials, and macroeconomics, in addition to contributing equity research to publications such as Seeking Alpha.