Thanks to the JOBS Act of 2012, startup investing, or crowdfunding, is now available to all Americans. But before we dive into crowdfunding, it is important to outline what constitutes a startup. Nowadays the term might seem like a buzz word more than anything, but the term “startup” has several implications, many of which are important to understand as a potential investor.

So what is a startup?

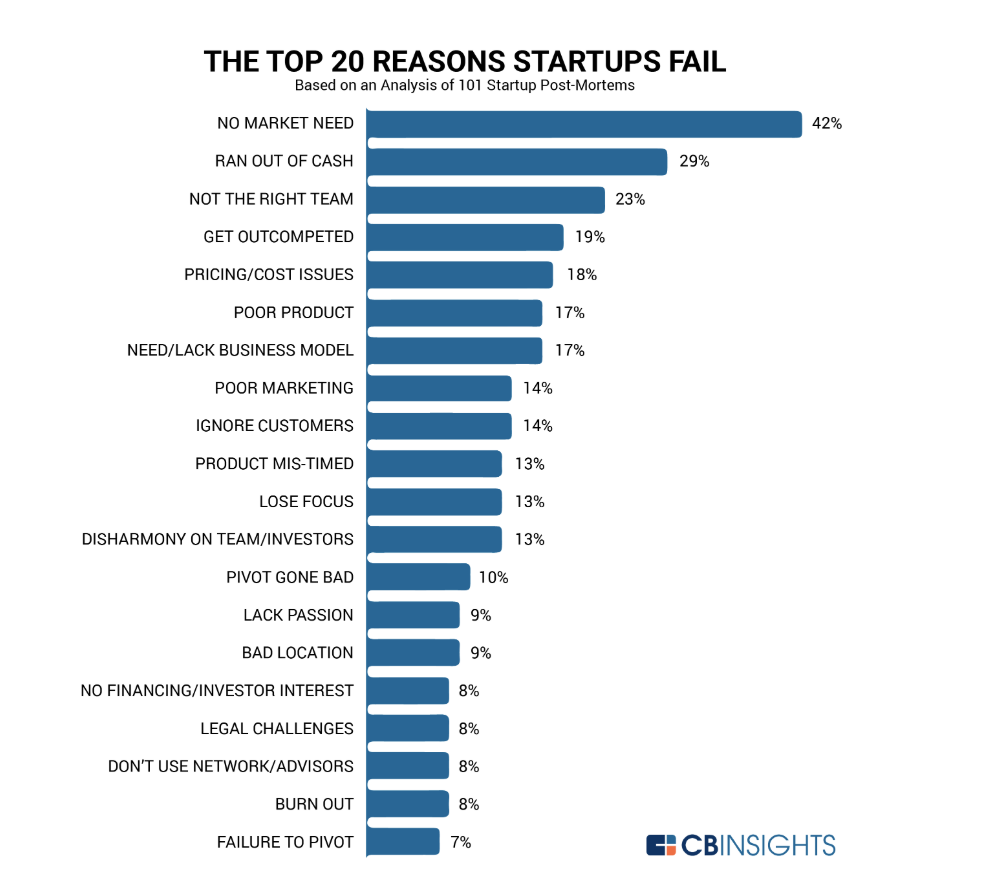

While there may not be one strict definition, there are known characteristics that often define startup investing. Neil Blumenthal, Co-Founder of Warby Parker explains “A startup is a company working to solve a problem where the solution is not obvious and success is not guaranteed.” In other words, startups often try to produce novel solutions to existing market pain points. Perhaps what should be most stressed in this definition, however, is that “success is not guaranteed.” Startups are inherently risky. In fact, nine out of ten startups will ultimately fail. So why are there so many eager founders? And why do we want to invest? Though the risk behind backing a startup is tremendous, so is the reward. Many of the big names we hear in the news today, Uber for example, began as a startup and yielded impressive returns.

Though the definition of “startup” is fluid, it also often refers to companies that are actively raising capital to create runway while their business gets off the ground, or “starts up.” Startups can raise money from venture capital firms (read more about venture firms and venture capital in our latest KC education piece) or they can turn to crowdfunding; some seek a combination of both.

Startup investing as a non accredited investor is a great way to get in at the ground floor with companies you believe in. Again, investing in startups is a high-risk, high-reward operation, but that’s where KingsCrowd comes in. We help you make the best decisions with your money all while aiding budding entrepreneurs and educating you on the space.

And with that, happy investing!